The Rise and Fall: Tesla Energy and Auto Divisions

On Wednesday, a seasoned bull of Tesla Energy (TSLA) increased the value of the company’s shares while decreasing the value that the EV behemoth’s auto division adds to the market. This comes after a lot of analysts referred to Tesla’s Q2 energy storage figures from last week as the company’s biggest delivery triumph.

High-profile auto analyst Adam Jonas of Morgan Stanley raised his target price for Tesla Energy to $50 per share on Wednesday, up from his prior estimate of $36 per share. He maintained his target price of $310 for Tesla shares. It equals a $183 billion enterprise. Jonas has revised his assessment of Tesla Energy in light of higher projected yearly sales growth and the expectation that gross margins will reach 26% in 2030 as opposed to the prior estimate of 23%.

Tesla Energy Sector Rises with Gen AI

According to Jonas’ post on Wednesday, there is increased interest in Tesla’s energy sector as generative artificial intelligence (Gen AI), drives up energy consumption. As previously stated by the analyst, Tesla Energy is “uniquely positioned to benefit from investment in the U.S. electrical grid accelerated by the AI boom.”

On Wednesday, Jonas also reduced his estimate for Tesla’s auto division by $15 to $56 per share. By 2030, according to Jonas, the market penetration of battery electric vehicles will have decreased, and there will be continued EV deceleration in the wake of China’s protectionism and a hybrid renaissance. According to the analyst’s projections, Tesla Energy’s margins will overtake the company’s vehicle margins in 2024, and it will be able to create $2.00 in earnings per share by 2030.

- Goldman Sachs maintained a neutral rating despite increasing its target price for Tesla from 175 to 248. In light of increased deliveries, the company also increased its earnings expectations for 2024.

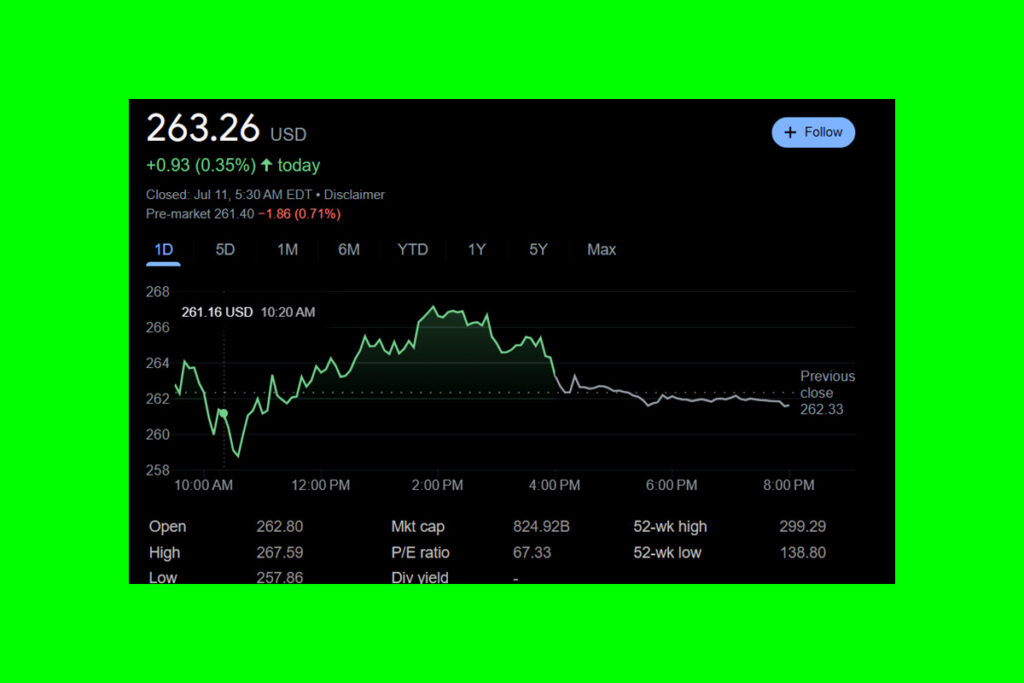

- Wednesday’s trading saw a 0.3% increase in Tesla shares to 263.26, marking the company’s 11th straight improvement.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a Reply