Tesla Share Price Hits New Heights in 2024

As the surge in electric vehicle (EV) stocks continued into Wednesday, Tesla (TSLA) shares are getting close to their highest price of the year. A number of analysts have raised their price estimates for the business after its second-quarter deliveries exceeded forecasts. Analysts at Wedbush Securities and Bank of America increased their price estimates from $220 to $275, respectively, to $260 and $300. The delivery figures, however, did not cheer J.P. Morgan analysts, who kept their “underweight” rating and $115 price target.

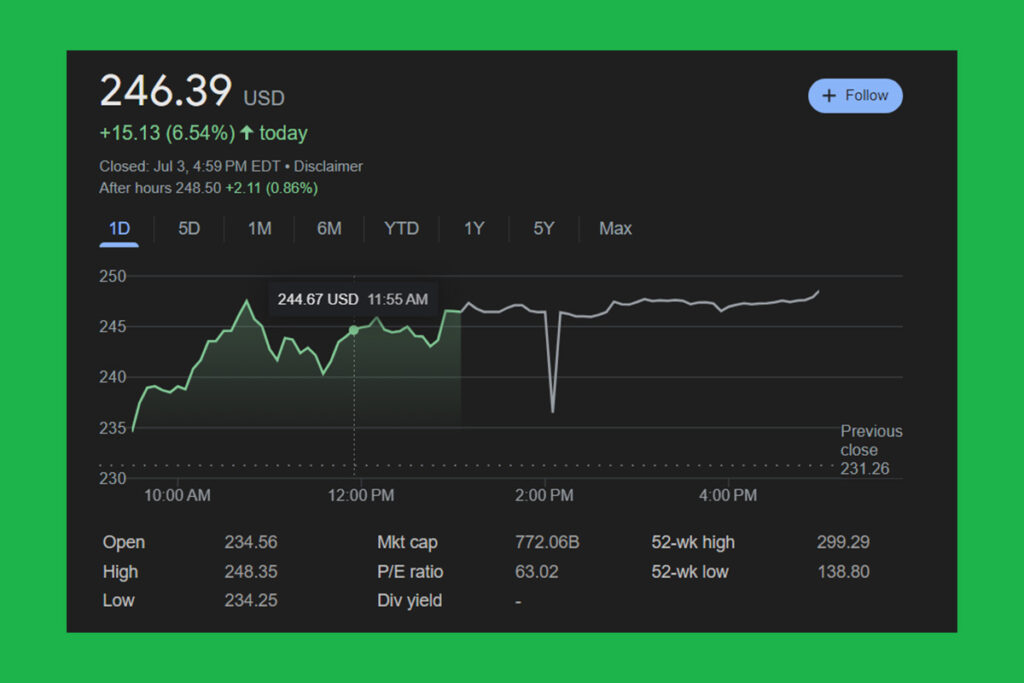

- Following better-than-expected second-quarter deliveries, analysts boosted their price forecasts for Tesla shares, which led to another spike in the stock on Wednesday.

- After rising over 25% just this week, Tesla shares are on the verge of reaching their highest point of the year.

- Ahead of its anticipated release of an autonomous robotaxi next month, Wedbush analysts increased their price target for Tesla and dubbed it the most undervalued AI play on the market.

Tesla’s Delivery Success and Signs of Electric Vehicle Market Recovery

According to a Tuesday note from Wedbush analysts, the global demand for electric vehicles looks to be stabilizing after declining earlier in 2024. They also noted that Tesla‘s delivery numbers were a significant turning point following the year’s extremely turbulent beginning. The growing number of more reasonably priced options this year and in the future should lead to increased EV volumes, according to a Tuesday analysis by Bank of America analysts. The EV market may be rebounding, as seen by delivery figures this week from several of Tesla’s rivals, including Rivian (RIVN) in the United States and several Chinese rivals.

“The key for Tesla’s stock is the Street recognizing that Tesla is the most undervalued AI play in the market in our view with a historical Robotaxi Day ahead for Musk and Tesla on August 8th that will lay the yellow brick road to FSD and an autonomous future,”

Wedbush analysts

- Tesla’s stock had a brief spike to $248.35, its highest level since January 2, when it hit $251.25, and ended the day up 6.5% at $246.39.

- Following its Tuesday and Monday index-leading performances, the stock was the third-biggest gainer on the S&P 500.

FAQ

What Factors Affect Tesla’s Share Price?

Tesla’s share price is affected by many factors, including vehicle sales figures, financial performance, new product launches, technological innovations, market competition, and the general economic situation.

What is the Impact of an Increase in Tesla’s Share Price on Investors?

An increase in Tesla’s share price could mean capital gains for existing investors, but higher entry costs for new investors. This may affect their investment strategy.

Will Tesla’s Share Price Increase Continue?

Whether Tesla’s share price will continue to rise depends on the company’s future performance and market conditions. Analyst reports and monitoring market trends can provide insight.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a Reply