Stock Market Futures – Relief Rally Boosts French Stocks After Election

Stock Market Futures – LONDON, July 1 (Reuters) – French banking shares led a strong rally in Paris on Monday following a historic first-round victory for Marine Le Pen’s National Rally (RN) party and its allies, easing some investor uncertainty.

CAC 40 Leads Regional Markets with 1.6% Surge, Yet Trails Pre-Election Peaks

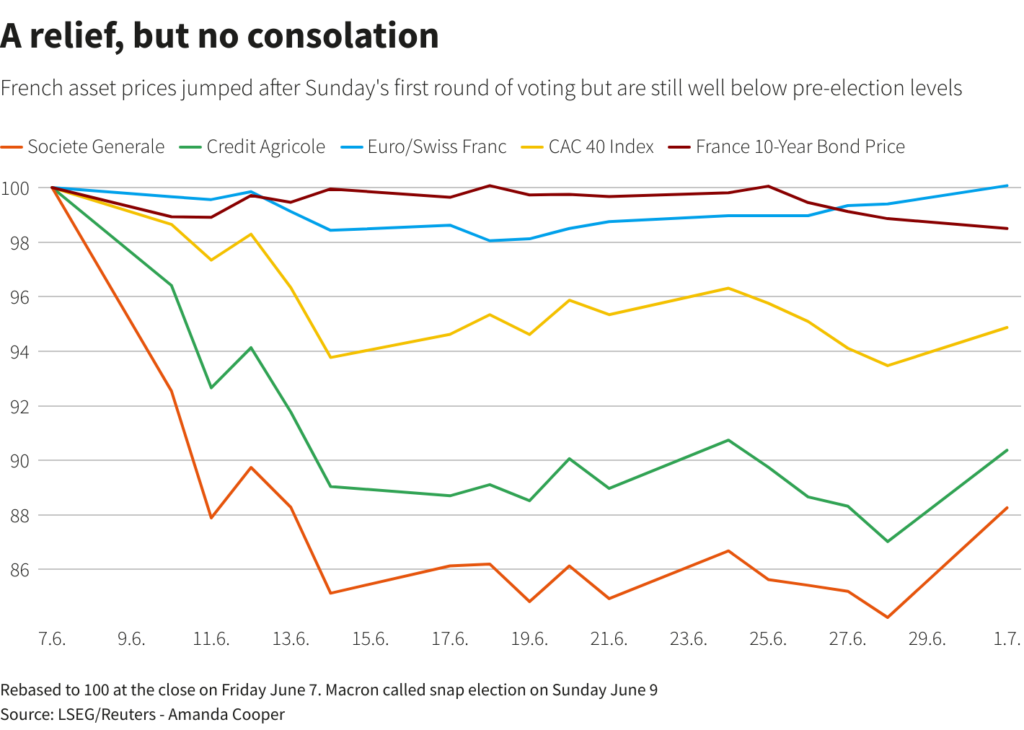

The CAC 40 index jumped 1.6%, outperforming the regional STOXX 600’s 0.5% rise, making it the top performer in the region. Despite this, it remains 5% below its pre-election levels from June 9, when President Emmanuel Macron called for the election.

Impact of Political Uncertainty on French Assets and Banking Sector

- French assets under pressure due to potential far-right or far-left majority.

- Concerns about increased government spending impacting France’s fragile finances.

- Shares of BNP Paribas, Credit Agricole, and Societe Generale rose by 4.1% to 4.7%.

- Cost of insuring their bonds against default at its lowest level in two weeks.

French assets have been under pressure since then, as the possibility of either far-right or far-left factions gaining a majority raised concerns about increased government spending and its impact on France’s fragile finances. Shares of the country’s three largest lenders – BNP Paribas, Credit Agricole, and Societe Generale – rose between 4.1% and 4.7%. Concurrently, the cost of insuring their bonds against default dropped to its lowest level in two weeks.

Economist Warns of Political Gridlock in France, Downplays Frexit Fears

“The outcome is likely better than feared, but not as reassuring as it was three weeks ago before the elections,” commented Mohit Kumar, Chief Economist at Jefferies. “We could be facing years of political gridlock in France, potentially stalling the reform process. However, fears of Frexit or a breakup of the eurozone are likely overblown.”

Bond Market Dynamics: French Yields Rise, Spread with Germany Narrows

Bond markets reflected mixed sentiment, with French 10-year government bond yields rising 4 basis points to 3.33%, their highest since November. The spread between French and German bond yields narrowed by 5 basis points to 75.3 basis points, down from above 82 basis points last week, marking its highest since 2012.

“In summary, uncertainty remains the only certainty. While French bonds may tighten relative to German bonds, the extent is limited amidst ongoing political ambiguity and high risk,” noted Alex Everett, Investment Manager at abrdn.

Hung Parliament Looms as RN Leads First-Round Voting in France

- RN and its allies secured 33% of the vote, leading the first-round results.

- A left-wing bloc followed with 28% of the vote.

- Macron’s centrists trailed with just 20% of the vote.

- A hung parliament remains likely pending the second-round parliamentary elections next week.

With RN and its allies securing 33% of the vote, followed by a left-wing bloc at 28% and Macron’s centrists trailing with just 20%, a hung parliament remains a probable outcome pending the second-round parliamentary elections next week.

“The scenario of a united left taking power and implementing a costly agenda now seems less likely,” added Holger Schmieding, Chief Economist at Berenberg. “The risks associated with political upheaval have somewhat receded.”

Euro Strengthens Amid Political Developments: Reaches Two-Week High Against Dollar and Swiss Franc

Meanwhile, amidst the political developments, the euro strengthened significantly in currency markets. It surged by 0.6% to reach a two-week high of $1.07705 against the dollar, reflecting renewed confidence. Similarly, against the Swiss franc, often seen as a safe-haven currency, the euro rose by 0.68% to 0.96905 francs, marking its highest level since June 7. These gains underscore a positive market response, contrasting sharply with the volatility preceding President Macron’s unexpected election announcement.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a Reply