Crypto News – Insights and Updates: 6-12 May Crypto Newsletter

Crypto News – The newsletter for this week includes information on Grayscale’s Ether ETF application, Block’s billionaire debt offering, Coincheck’s merger agreement, and Robinhood’s Wells notice.

Robinhood Crypto Operation Faces SEC Wells Notice: What’s Next?

On May 4, the U.S. SEC sent Robinhood a Wells notice, indicating that it may take enforcement action for alleged securities breaches. Despite Robinhood’s attempts to abide by regulations, such as not listing particular coins or offering crypto loans and staking services, the SEC has reportedly been looking into the platform’s cryptocurrency listings and custodial activities, according to a regulatory filing.

Grayscale’s Ethereum Futures ETF Application Withdrawal: What You Need to Know?

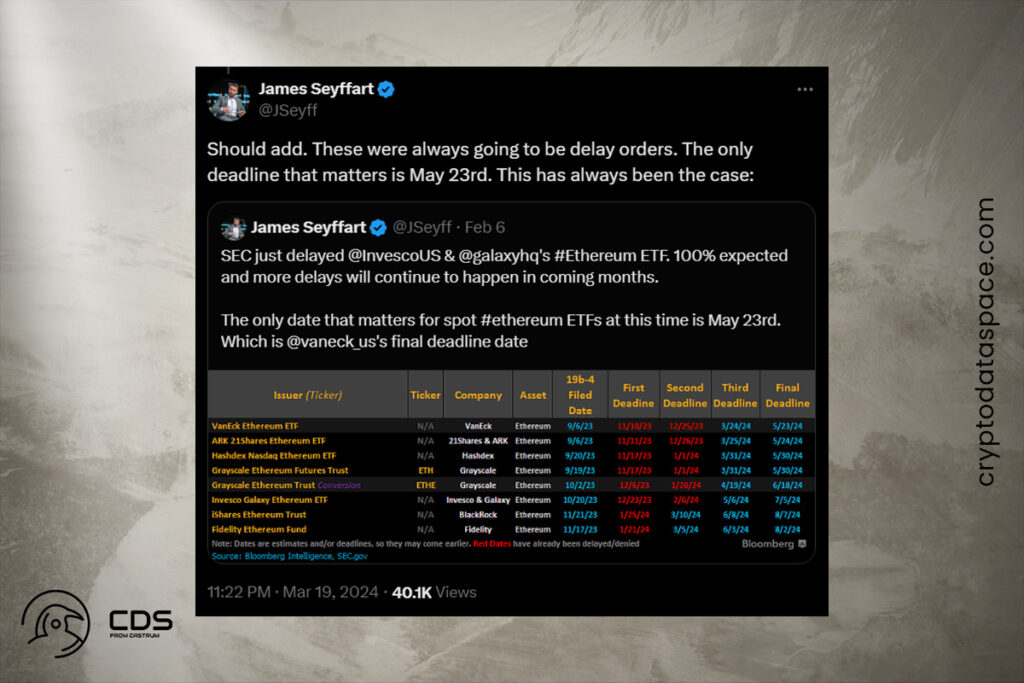

Three weeks before the SEC was supposed to make a decision, Grayscale withdrew its 19b-4 application for an Ether futures ETF. On May 7, the cryptocurrency asset management notified the SEC of the Grayscale Ethereum Futures Trust’s withdrawal. Grayscale reportedly planned to use the ETF as a “trojan horse” to coerce the SEC into approving its spot Ether ETF, according to a previous analysis by Bloomberg analyst James Seyffart.

Coincheck and Thunder Bridge: A Closer Look at Their Nasdaq Listing Progress

The merger and Nasdaq listing of Japanese cryptocurrency exchange Coincheck and Thunder Bridge Capital are getting closer. The firms submitted a Form F-4 registration statement with the U.S. SEC on May 7, according to a press release. This was a significant step in their two-year process of preparing for an initial public offering.

The merger’s initial $1.25 billion valuation was pushed back due to the extreme bear market and unsettling regulatory environment that followed FTX’s collapse. It is now anticipated that the transaction will close in 2024’s second or third quarter.

Exploring the Potential of Jack Dorsey’s $1.5 Billion Senior Notes Offering

Block, the fintech company founded by Jack Dorsey, has revealed plans to raise at least $1.5 billion by way of a private senior note issuance. The proceeds will be used by the corporation for ordinary corporate reasons, including debt reduction and capital expenditures. Two series of notes, having maturities of 2027 and 2033, will be available.

FAQ

What is a Wells Notice?

The U.S. Securities and Exchange Commission will formally notify an individual or business that they were the subject of a closed investigation through the use of a Wells notice.

What Does it Mean to be Listed on the NASDAQ?

In order to be listed, corporations need to fulfill certain financial requirements to be listed on the NASDAQ-NM. They have to keep the value of their outstanding shares at least $1.1 million and the price of their stock at least $1.

What Does a Senior Note Offering Mean?

Senior Note Offering means a certain private placement by the parent conducted pursuant to Section 4(2) of the Securities Act of Senior Notes for resale to “qualified institutional buyers” under Rule 144A under the Securities Act.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a Reply