Bitcoin price- Bitcoin investors express optimism despite the downward revision of BTC price targets

Bitcoin price- On July 4, Bitcoin continued its downward correction, experiencing a decline of 3.34% in the last 24 hours and a total drop of 5.82% over the past week. According to data from Cointelegraph Markets Pro and TradingView, Bitcoin (BTC) fell to a one-month low of $56,709 after losing the critical psychological support level of $60,000.

At the same time, the overall market capitalization saw a significant decrease of 4.23% over the past 24 hours, settling at $2.13 trillion at the time of writing. This drop in market cap coincided with a substantial 42% increase in total trading volume, highlighting the intense sell-off pressure within the crypto market.

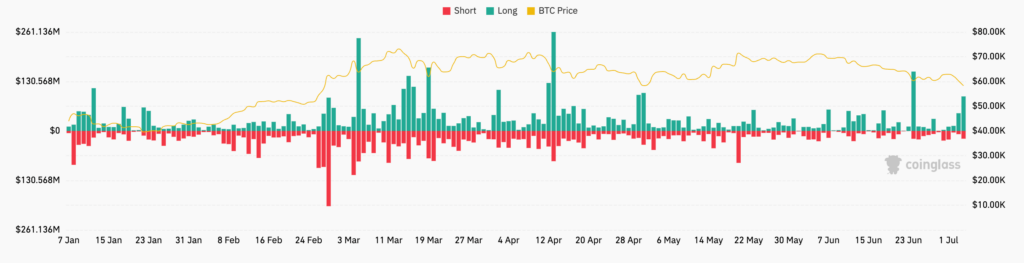

Bitcoin’s dip below the $57,000 mark on June 4 triggered widespread liquidations across the cryptocurrency market. Data from CoinGlass reveals that in the past 24 hours alone, approximately $98.04 million worth of long Bitcoin positions were liquidated, compared to $22.6 million in short position liquidations.

Moreover, the broader crypto market saw around $333.1 million in leveraged long positions liquidated over the same period, against $50.52 million in short positions. This large-scale liquidation event underscores the high volatility and the risks associated with leveraged trading in the cryptocurrency market.

As Bitcoin struggles to regain its footing, traders and investors are closely monitoring market conditions, looking for signs of stability or further declines. The recent correction serves as a stark reminder of the market’s volatility and the importance of risk management in trading strategies.

Analysts Remain Optimistic Despite Bitcoin’s Bearish Trend

Despite the bearish price action across the entire crypto sector, led predominantly by Bitcoin, analysts maintain a sense of optimism about BTC’s potential recovery to higher levels. This sentiment persists even as Bitcoin struggles to regain its footing amid the recent market downturn.

The Significance of the 200-Day EMA

The 200-day EMA is a significant technical indicator that many traders and analysts use to gauge the overall market trend. When Bitcoin dropped below this level, it was seen as a bearish signal. However, the subsequent recovery back above the 200-day EMA has rekindled hopes for a potential rebound.

Potential for a Bullish Reversal

Jelle explained that if Bitcoin’s price manages to produce a daily candlestick close above the 200-day EMA, it would signal a successful sweep of the lows. This could be followed by a retest of the 200-day EMA, which might indicate a potential bullish divergence from the daily relative strength index (RSI). A bullish divergence occurs when the price of an asset makes a new low while the RSI makes a higher low, often seen as a sign that the bearish momentum is weakening.

Broader Implications for the Crypto Market

Analysts’ cautious optimism is not limited to Bitcoin alone but extends to the broader crypto market. The performance of Bitcoin often sets the tone for other cryptocurrencies, and a recovery in BTC could potentially signal a broader market recovery.

Optimism Amidst Volatility

Bitcoin bouncing back up, now back above the 200-day EMA, noted Bitcoin analyst Jelle in a June 4 post on X. This statement reflects a cautious optimism based on Bitcoin’s recent price movements, despite the overall bearish trend. Jelle’s observation comes after Bitcoin experienced a drop below the crucial 200-day exponential moving average (EMA) during the early Asian trading session on June 4, as previously reported by Cointelegraph.

Bitcoin’s Recent Price Movements and Analyst Insights

At the time of writing, Bitcoin’s price had rebounded above the 200-day exponential moving average (EMA), which is currently set at $58,256.

Rekt Capital, a well-known analyst, noted that Bitcoin’s current 22% pullback has lasted approximately 45 days, describing it as an above-average pullback. This indicates that the recent correction is more significant than typical dips observed in Bitcoin’s price.

On the other hand, the pseudonymous analyst Yoddha offered a more succinct perspective, stating that the local bottom is in for Bitcoin. This suggests that Yoddha believes the lowest point of the recent decline has been reached.

For the latest in crypto updates, keep tabs on Crypto Data Space.

Leave a Reply