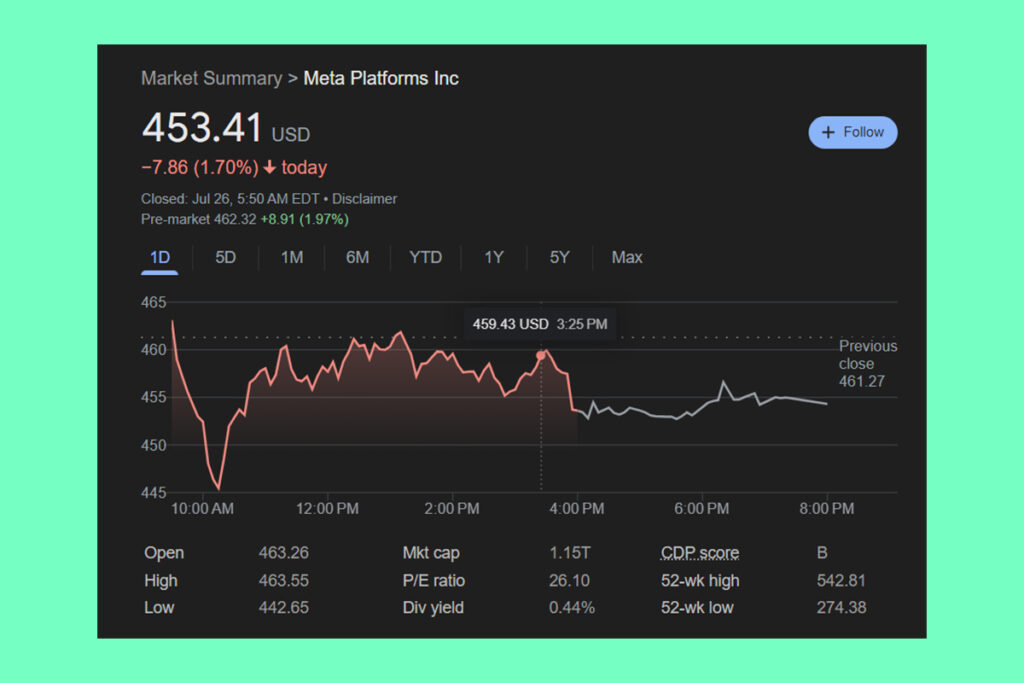

Today’s Developments in Meta Stocks and Market Reactions

On Friday, the stock of Meta Platforms Inc. is down. According to an exclusive report by Reuters, the technology giant is set to get its first EU antitrust sanction for connecting its Marketplace classified ads program with Facebook.

- The European Commission made its verdict almost eighteen months after Meta was charged with unjustly combining the two services into one.

- According to the EU competition authorities, Meta abused its market dominance by forcing competitors’ online classified ad services that use Facebook or Instagram to accept unfair trading conditions.

- A fine of up to $13.4 billion, or 10% of Meta’s global revenue in 2023, may be imposed, though EU fines are usually far smaller.

Meta’s Defense of Facebook Marketplace: EU Antitrust Review and Decision Date

Prior to EU antitrust chief Margrethe Vestager’s departure in November, the European Commission is anticipated to make its decision in September or October.

The claims made by the European Commission are without foundation. We continue to work constructively with regulatory authorities to demonstrate that our product innovation is pro-consumer and pro-competitive.

Meta spokesperson Matt Pollard

Last year, Meta made an effort to end the EU probe by limiting Facebook Marketplace‘s use of rivals’ advertising data, but the EU enforcer turned down this proposal. On the other hand, a similar idea was approved by the competition authority in the UK. Because of its recently implemented pay-or-consent advertising approach, which was adopted in November, Meta was accused earlier this month by the European Commission of violating new digital regulations.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a Reply