Top Crypto Updates Of July: Ethereum ETF Approval, US CPI Data, and New Tokens and Aptos Get Unlock

Top Crypto Updates Of July – Welcome to our weekly crypto trend newsletter, your go-to source for the latest updates. This week’s highlights include the anticipated approval of the Spot Ethereum ETF, the US CPI data release on July 11, and the emergence of new tokens like Aptos. Key news features the US lawmakers’ vote on SEC’s SAB 121, potentially impacting digital asset regulations, and the German government transferring over 3,000 Bitcoin amidst a sell-off. We’ll also cover the Mt. Gox repayments and Bitcoin’s recent price drop to $54,200 after a weekend recovery. Stay ahead with our concise coverage of these crucial events.

Key Crypto Highlights:

- US Lawmakers Vote on SEC’s SAB 121: Potential impact on digital asset regulations.

- Spot Ethereum ETFs: Expected approval and potential launch next week.

- US CPI Data Release on July 11: Possible influence on Fed policy decisions and the crypto market.

✍️ This week’s bıggest crypto news:

Mt. Gox Repayments: What You Need To Know?

German Government Transfers Over 3,000 Bitcoin Amid Continued Sell-Off

BTC Price- Bitcoin Falls To $54,200 Following Weekend Recovery

Crucial Vote on Crypto Legislation in Congress

This week, the crypto community is closely monitoring a significant vote in Congress on H.J. Res. 109, which aims to overturn the controversial SEC Staff Accounting Bulletin 121 (SAB 121). House Majority Leader Steve Scalise has indicated the vote may take place on Tuesday or Wednesday.

- Impact of SAB 121: This bulletin requires financial institutions to report their customers’ digital assets on their balance sheets, a move criticized for excluding digital assets from the US financial system.

Key Legislative Vote on Crypto Regulation

U.S. lawmakers are set to vote on H.J. Res. 109 to potentially overturn the SEC’s controversial SAB 121. This bulletin mandates financial institutions to include customers’ digital assets on their balance sheets, a rule criticized for excluding digital assets from the U.S. financial system.

Although the House and Senate previously passed the repeal in May, President Joe Biden vetoed the bill, stressing his administration’s commitment to protecting consumers and investors. This vote is seen as pivotal for the broader crypto industry.

Anticipated Approval for Spot Ethereum ETFs

Excitement is growing around the potential approval of spot Ethereum (ETH) exchange-traded funds (ETFs). Following updates to S-1 forms by several asset managers, experts believe these ETFs could be approved soon.

- Market Expectations: Bloomberg Intelligence’s ETF analysts, James Seyffart and Eric Balchunas, predict that these ETFs could list as early as next week or by July 15. Nate Geraci, president of ETF Store, also expects trading to begin within the next two weeks.

- Potential Approval of Ethereum ETFs : Experts predict that spot Ethereum ETFs might soon be approved, possibly launching by mid-July. This could significantly impact Ethereum’s market dynamics, though ETH’s price has fallen by 26% since preliminary approvals.

However, the SEC’s approval process remains a key factor. While the SEC has approved the 19b-4 forms, the S-1 forms still need approval before trading can commence.

- ETH Price Decline: Since the preliminary approval of the 19b-4 forms in late May, ETH’s price has dropped by about 26%, now trading at $2,887 according to Tradingview data.

Implications of US CPI Data Release

The US Consumer Price Index (CPI) data for June, set for release on July 11, is a critical event for financial and crypto markets. The May data showed no month-to-month increase, easing some inflation concerns.

- Forecasts: The Federal Reserve Bank of Cleveland projects a 0.08% monthly increase in headline CPI inflation and a 0.28% increase in core CPI inflation, excluding food and energy. While these estimates are not always precise, they provide a general direction for inflation trends.

- Upcoming US CPI Data Release The U.S. Consumer Price Index (CPI) data, scheduled for July 11, could influence Federal Reserve policy decisions, impacting both the financial and crypto markets.

The Federal Reserve will closely monitor these figures at their next policy meeting on July 30-31 to guide their policy decisions.

- Market Impact: Lower inflation could indicate economic stability, boosting investor confidence and potentially driving funds into cryptocurrencies. Conversely, higher-than-expected inflation might prompt the Federal Reserve to hold or raise interest rates, creating market uncertainty.

Given the volatile nature of cryptocurrencies, significant price movements in response to these economic indicators are likely. Therefore, investors should closely follow the CPI data and Fed decisions to navigate the market effectively.

Jupiter Proposes Significant Supply Reduction

Jupiter, a decentralized exchange (DEX) on the Solana network, is planning a major adjustment to its tokenomics. The proposal suggests reducing the total supply of its native token, JUP, by 30%.

- Proposal Details: The proposal, presented by the pseudonymous co-founder Meow, includes a voluntary team cut of 30% from their allocated tokens and a corresponding reduction in January emissions. The governance vote on this proposal will take place in July.

- Jupiter’s Token Supply Reduction Proposal

Jupiter, a Solana-based DEX, proposes a 30% reduction in its native token, JUP, to improve its tokenomics. A governance vote on this proposal is expected in July.

Meow highlights that Jupiter’s lack of direct investors allows the team to make bold decisions to optimize tokenomics, aiming to address high emissions levels and strengthen community engagement.

Stay Updated: Keep informed about the latest crypto news and catch the market flow.

Vela V2 Launches with Upgrades

Vela, an Arbitrum-native perpetual DEX, is set to launch Vela V2 on July 8. This new version will introduce improved tokenomics, a new trading competition, and enhanced features.

- New Features: Vela V2 includes flexible vesting options, governance voting, and a streamlined staking page. To encourage participation, Vela V2 will feature a 500,000 ARB prize pool in Grand Prix Season 3.

- Launch of Vela V2 Vela, an Arbitrum-native perpetual DEX, will launch its Vela V2 with upgraded features and a trading competition on July 8.

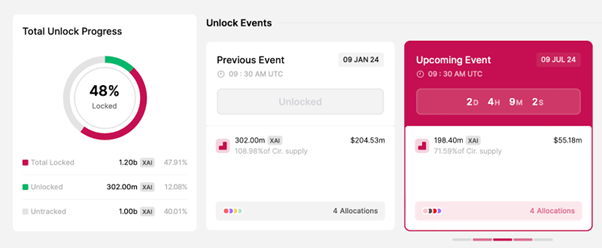

Major Token Unlocks This Week: Xai and APT

Xai, a layer-3 (L3) solution designed for AAA gaming, will unlock nearly 200 million XAI tokens on July 9, worth approximately $55.18 million. This represents 71.59% of its circulating supply, sparking discussions about its potential price impact.

- Aptos Token Unlock: On July 12, Aptos will release 11.3 million APT tokens to community members, core contributors, and investors. This accounts for 2.49% of its circulating supply, valued at around $62.88 million.

- Major Token Unlocks Xai, a layer-3 solution for AAA gaming, will unlock 200 million XAI tokens on July 9, while Aptos will unlock 11.3 million APT tokens on July 12, potentially affecting their market prices.

Other projects like Immutable (IMX) will also have token unlocks during this period. For more detailed information on major crypto token unlocks this week.

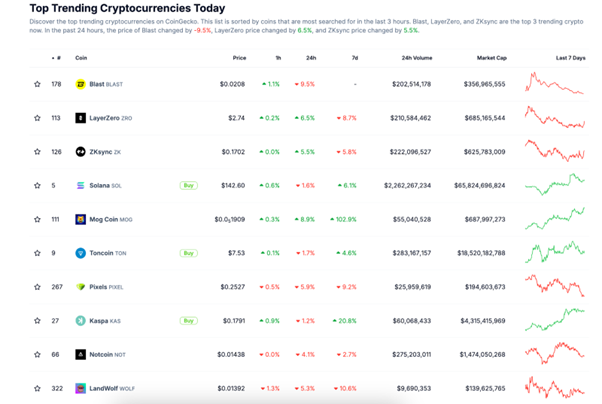

Top 10 Trending Crypto Today

THIS WEEK TREND CRYPTO NEWS

Bitcoin Price Drops As German Federal Agency Sells Millions In Crypto Seized From Movie Piracy

Reasons Why Shiba Inu Coin Burn Rate Surged By 530% And What It Means For SHIB Price

Why Is Crypto Crashing – Bitcoin’s ‘Worst In History’ Crash Propels It Toward A $1.9 Trillion Shock

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a Reply