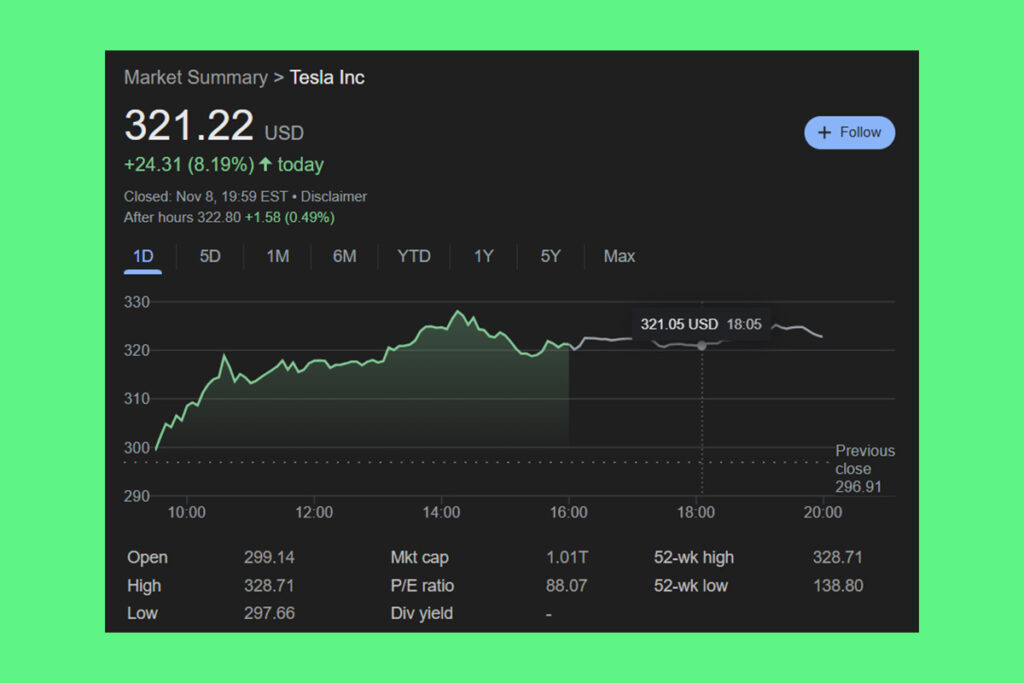

Trump Speculation Sends Tesla Shares Surge 9%, Reaches $325 and a $1 Trillion Market Cap

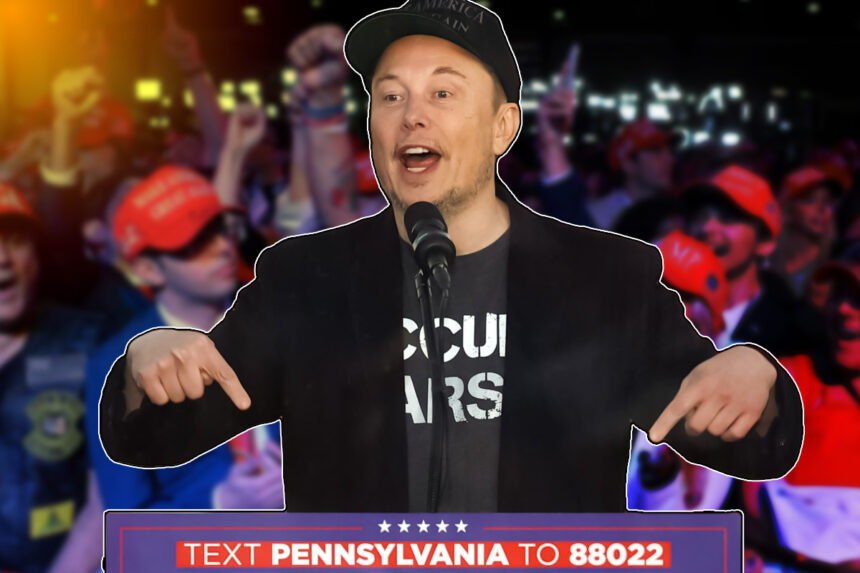

As Wall Street analysts wager that Elon Musk‘s business would profit from Donald Trump’s return to the White House, Tesla’s stock rose once more on Friday, concluding an eventful week for the electric vehicle manufacturer. Tesla’s market capitalization surpassed $1 trillion as its shares surged more than 9% Friday afternoon to over $325, breaking the $300 threshold for the first time since 2022. This week, the stock has increased by 30%.

Bank of America Raises Tesla Price Target to $350, Citing Trump’s Potential Regulatory Easing

Already generally optimistic about Tesla, analysts became even more so. Analysts at Bank of America increased their price estimate for Tesla on Thursday from $265 to $350, pointing to the possibility of less stringent regulations under the Trump administration that might improve the company’s robotaxi development prospects.

They added that the business would also find it easier to put out the robotaxis scheduled for next year if the Trump administration supported Musk’s proposed national standard for self-driving cars. Additionally, Musk’s relationship with Trump may assist prevent competition, as increased tariffs targeted at China prevent cheaper imports from China and the president-elect’s anticipated efforts to relax environmental rules hinder the ramp-up of EVs by competitor automakers.

It is difficult to judge how Elon Musk’s increasingly close public relationship with President Trump could benefit Tesla, but this needs to be monitored closely,

the analysts

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a Reply