Stock market news- Are US stocks at a turning point?

Stock market news- The remarkable ascent of the S&P 500 has long been seen as a reflection of the robust economic growth in the United States. With its continuous rise, it’s easy to view this index as emblematic of the broader economic prosperity.

However, there are indications that the situation might be shifting. Recent declines in the index’s price could merely represent a minor market correction. Yet, beneath the surface, broader market performance has been less impressive for some time.

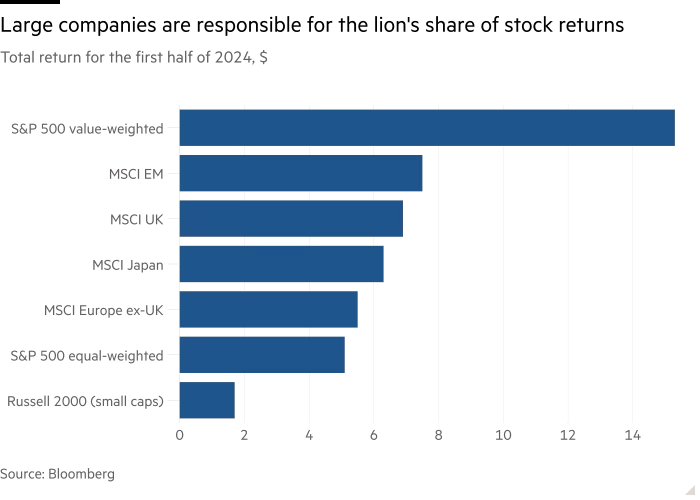

In the first half of 2024, the top 20 US-listed stocks alone delivered a substantial 27% gain, contributing to three-quarters of the total US market return of 15.3%, as reported by JPMorgan. In contrast, an equally weighted version of the S&P 500 index has lagged behind other major global stock markets. In fact, it experienced losses in the second quarter. Small-cap stocks, which are more focused on domestic markets, have fared even worse. Although they showed some recovery last week, marking their strongest five-day outperformance against large-cap stocks in at least forty years, according to Goldman Sachs.

The S&P 500’s Rise: A Sign of Exceptional Growth or a Signal of Change?

This behavior is unusual when viewed over a longer period. Typically, the equally weighted S&P 500 index—where each stock has an equal share in the benchmark—tends to move in line with and even outperform the main S&P 500 index, which is weighted by market capitalization. Since 1990, there have been only nine quarters where an equally weighted basket of stocks underperformed in a rising market. Notably, two of these quarters occurred in the past three years, during which the equal-weighted index has consistently lagged by more than five percentage points per year.

This trend is particularly surprising given the backdrop of exceptional national economic growth. Over the past three years, with nominal GDP growth approaching 8% annually, one would expect to see healthy profit growth across the board. Indeed, larger companies have seen sales growth keeping pace with this economic expansion. However, smaller businesses have struggled, with their revenues falling behind and overall earnings dropping sharply over the past 18 months, leaving them below levels seen three years ago.

What explains these developments? Looking back, higher interest rates provide some insight into the weakening fundamentals. While debt-free, cash-rich tech giants are somewhat insulated, they still feel the impact of higher rates indirectly when their customers’ financial struggles lead to reduced orders. On the other hand, labor-intensive companies that carry debt—more accurately represented by equally weighted indices—face increased pressure. They are squeezed by both rising input costs and the broader monetary policy aimed at addressing these issues. Essentially, monetary policy can act as a double-edged sword, impacting different segments of the market in various ways.

Despite the weakening fundamentals observed in indebted businesses, this decline hasn’t yet fully manifested in the corporate bond markets. Traditionally, one would expect to see signs of distress in credit markets when companies face financial strain. However, credit spreads—essentially the difference in yield between corporate bonds and risk-free government securities—have continued to narrow across nearly all levels of credit quality. This remains true even in the face of tighter lending standards, weakened demand, and higher risk premiums reported in the Federal Reserve’s Senior Officer Loan Survey. These factors would normally suggest increasing credit market stress.

Current Trends and Future Outlook for Corporate Bonds and the US Economy

To reconcile this anomaly, it’s important to consider that many companies with high levels of debt are actively managing their financial burdens by paying down their obligations where possible. This adjustment reflects the broader impacts of monetary policy, which aims to stabilize economic conditions. In segments of the market where debt reduction is more challenging, such as the riskiest areas of the US high-yield market, there has been a noticeable widening of spreads for CCC-rated bonds and a rise in default rates. Nonetheless, forecasts for this sector remain mixed, indicating uncertainty about future trends.

For the latest in crypto updates, keep tabs on Crypto Data Space.

Leave a Reply