PLTR Stock: Where Is Palantir Technologies Heading in 5 Years?

PLTR Stock – Investors have shown strong interest in Palantir Technologies (NYSE: PLTR) in 2024, with the stock soaring 67%. Known for its data analysis software platforms for government and commercial clients, Palantir’s surge is attributed to the widespread adoption of artificial intelligence (AI). This technology has significantly bolstered the company’s revenue pipeline, positioning it for substantial growth in the coming years.

Expanding Market Opportunities

Palantir operates in a rapidly expanding AI software market, projected to grow at 23% annually through 2032, reaching over $1 trillion in revenue. With $2.3 billion in trailing 12-month revenue, Palantir has ample room for expansion. Notably, the company reported a 21% year-over-year revenue increase to $634 million in Q1 2024, driven by robust commercial sector performance.

Accelerated Commercial Revenue Growth

Palantir’s commercial revenue surged 27% year over year in Q1 2024, totaling $299 million, outpacing overall revenue growth. U.S. commercial revenue grew even faster at 40%, underscoring the growing adoption of Palantir’s AI software platforms. Management highlighted significant customer acquisition and revenue growth in the U.S. commercial sector, driven by the adoption of their Artificial Intelligence Platform (AIP).

Promising Growth Metrics

The company’s remaining deal value increased by 22% to $4.1 billion, with remaining performance obligations up 39% year over year to $1.3 billion in Q1. These metrics indicate strong future growth potential, reflecting robust demand for Palantir’s solutions and expanding market penetration.

Profitability and Margin Improvement

Palantir’s non-GAAP operating margin improved by 12 percentage points to 36% in Q1 2024, driven by favorable unit economics and increased throughput. The company anticipates continued margin expansion, enhancing its bottom-line growth prospects.

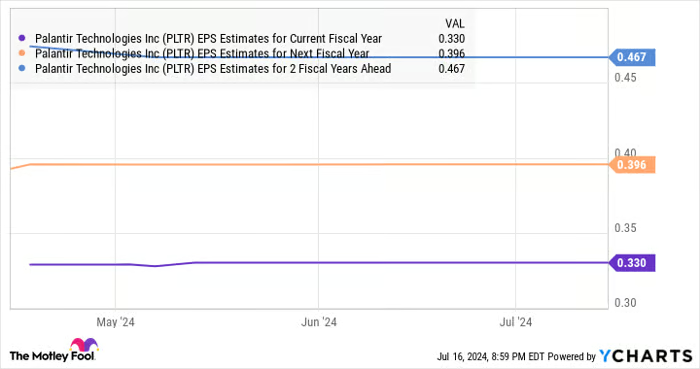

Future Earnings Growth Forecast

Analysts forecast Palantir’s earnings to grow at an impressive annual rate of 85% over the next five years, supported by its large addressable market and improving profitability. The stock is considered undervalued based on its PEG ratio, indicating potential for significant appreciation as AI adoption continues to drive growth.

Investment Considerations

Investors contemplating Palantir Technologies should weigh its strong growth prospects against broader market opportunities. While the stock may not have been featured in recent top stock picks, its potential for substantial returns remains compelling, particularly for long-term growth investors.

Palantir Technologies stands poised to capitalize on the expanding AI software market, supported by robust revenue growth, margin improvement, and optimistic earnings forecasts. As AI adoption accelerates across sectors, Palantir’s innovative solutions position it as a key player in shaping the future of data analytics and software platforms. Investors looking for growth opportunities in the technology sector should consider Palantir Technologies as a promising investment choice.

FAQ

Why is Palantir Technologies stock so popular?

Palantir Technologies (NYSE: PLTR) is known for its data analysis software platforms serving government and commercial clients. Recent widespread adoption of artificial intelligence (AI) technology has significantly boosted the company’s revenue pipeline, driving strong investor interest and stock appreciation.

What is Palantir’s growth potential?

Palantir operates in a rapidly expanding AI software market projected to grow at an annual rate of 23% through 2032, aiming to reach over $1 trillion in revenue. With robust revenue growth and improving profitability, the company is well-positioned for substantial expansion.

How is Palantir performing financially?

Palantir reported a 21% year-over-year revenue increase to $634 million in Q1 2024, with commercial revenue up 27% to $299 million. The company’s strong financial metrics, including growing remaining deal value and performance obligations, highlight its promising future growth potential.

Why should investors consider Palantir Technologies?

Investors interested in technology sector growth opportunities may find Palantir appealing due to its innovative AI solutions, strong financial performance, and optimistic earnings forecasts. Analysts project significant earnings growth, supporting the stock’s potential for long-term appreciation.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a Reply