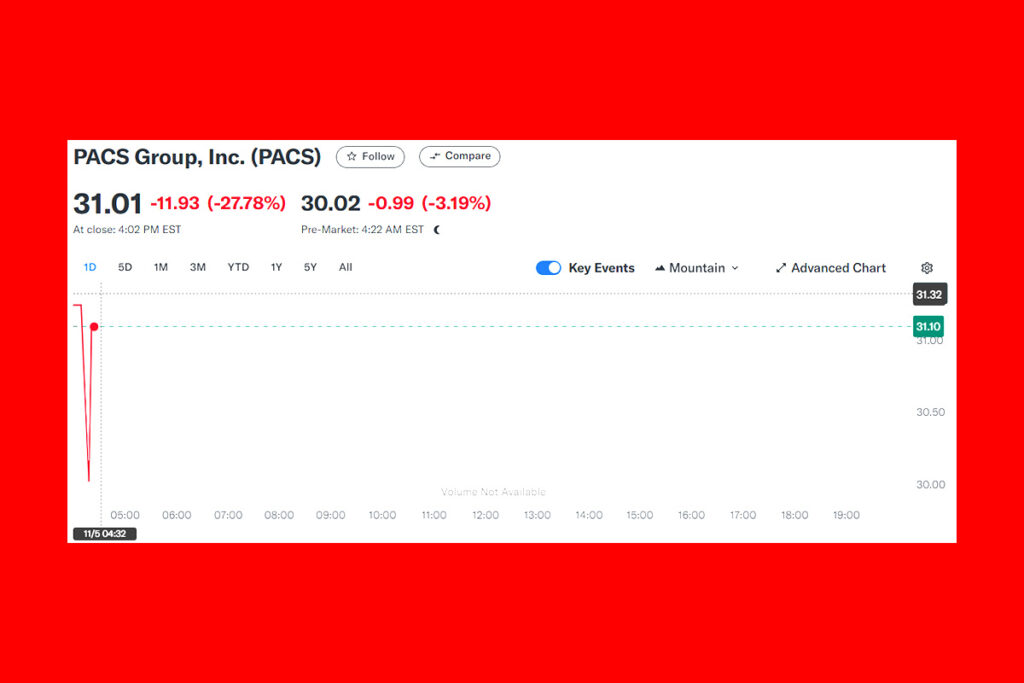

PACS Group Shares Sink as Hindenburg Report Accuses Company of Fraud

After Hindenburg Research published a brief report on Monday accusing the nursing home operator of systematically scamming taxpayers, shares of PACS Group Inc. fell 28%. PACS had its worst day since going public in April as a result of the decline, which caused volatility to halt in the company’s shares. Friday saw the stock settle at a record high of $42.94, more than double the $21 price at which it was first offered to the public.

PACS Group’s $6.7B Valuation Under Scrutiny After Hindenburg Report and New Acquisitions

According to a recent filing, PACS serves over 27,000 patients per day and oversees roughly 284 nursing homes spread over 16 states. PACS announced last week that it has completed the purchase of eight nursing homes in Pennsylvania, four of which are under lease from CareTrust REIT Inc. The largest one-day decline in CareTrust shares since September 2022 was 4%. PACS shares, valued at over $6.7 billion at the close of business on Friday, had risen on the strength of two quarterly earnings reports that exceeded forecasts and an increase in the company’s revenue and profit outlook for the year. Following the market closing on Thursday, PACS is expected to release its third-quarter earnings.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a Reply