Ola Electric Share Price Performance: Three-Day Loss Streak Amid Market Challenges

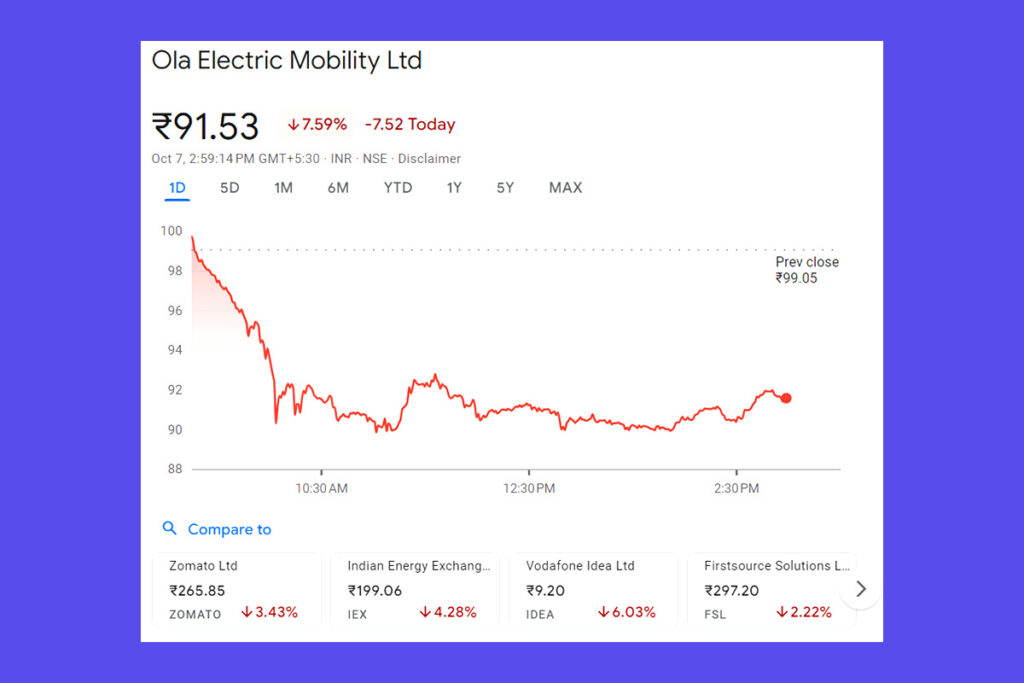

Ola Electric Mobility Ltd. is presently encountering noteworthy difficulties in the stock market, as seen by a considerable decrease in its share price. By October 7, 2024, the price of the stock had dropped to ₹90.76, a decrease of almost 8.4%. From its top of ₹157.4, which it attained soon after its IPO filing in August at an issue price of ₹76, this is a significant decline of 43%. Over the last few trading sessions, the stock’s performance has been mediocre. Ola Electric has lost money for the past three days in a row; throughout the previous six trading days, the company has experienced decreases.

Competition Heating Up: How Bajaj Auto and TVS Motor Challenge Ola Electric’s Dominance?

Ola Electric’s diminishing market share in the electric vehicle (EV) industry is a significant element influencing the company’s stock performance. Ola’s market share fell from 52% in April to just 27% by September, according to data from VAHAN. The decrease in sales is ascribed to heightened rivalry from well-established competitors such as Bajaj Auto and TVS Motor. These companies have enhanced their electric vehicle (EV) portfolios and have amassed substantial market shares, currently hovering around 20% apiece.

Regarding Ola Electric’s market strategy and service quality, analysts have voiced concerns. These problems were emphasized in a recent note from HSBC, which maintained a “buy” rating with a price target of ₹140 but advised caution in dealing with the stock. As the brokerage gets ready to launch new products, it stresses how important it is to keep upping the quality of its services.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a Reply