Nvidia Stock Could Hit $175 According to Wall Street Analyst: Should You Buy?

Nvidia stock has experienced considerable volatility recently. After a period of impressive growth, the stock has suffered a significant decline, falling over 16% from its peak. This drop has been attributed to a combination of geopolitical risks and disappointing earnings reports from other major tech companies. Despite this downturn, there are indications that Nvidia might be on the brink of a recovery.

Loop Capital’s Optimistic Forecast

Recent analysis from Loop Capital has provided a hopeful outlook for Nvidia. In a note published on July 22, Ananda Baruah, the firm’s lead analyst on Nvidia, reiterated a buy rating for the company. Baruah’s optimism is reflected in his revised price target for Nvidia, which has been raised from $120 per share to $175 per share. At the time of writing, Nvidia’s stock is trading at $114.25 per share. Baruah’s new target implies a potential upside of approximately 54% over the next 12 months, signaling a significant rebound potential for the stock.

Is Wall Street Underestimating Nvidia?

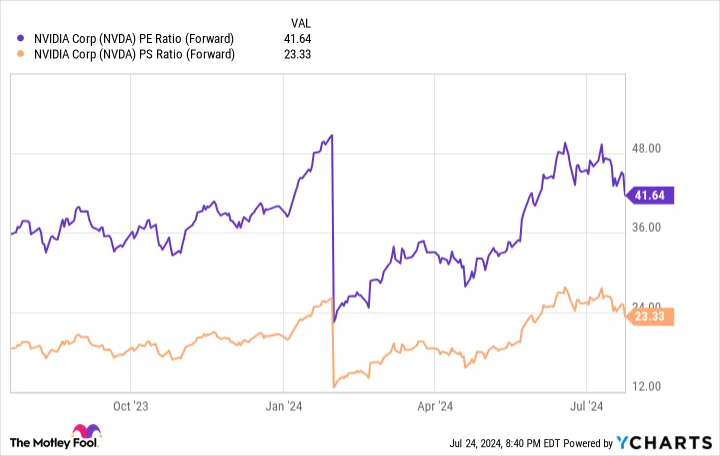

Loop Capital’s analysis suggests that Wall Street might be underestimating Nvidia’s potential. Baruah highlights that Nvidia’s data center segment could achieve revenues between $215 billion and $240 billion, surpassing the average analyst estimate of $145 billion. Similarly, the analyst forecasts that Nvidia’s compute segment could generate sales between $200 billion and $225 billion, ahead of the typical Wall Street target of $132 billion. This optimistic view is based on Nvidia’s rapid business expansion, which could indicate that the stock is undervalued despite its high-growth valuation.

Last quarter, Nvidia reported a staggering 262% year-over-year increase in revenue, reaching $26 billion. Earnings per share surged 629% compared to the previous year. This remarkable growth highlights the strong demand for Nvidia’s products and suggests that the company is well-positioned to maintain impressive profit margins through the rest of the year. For long-term investors interested in capitalizing on leaders in the AI sector, this recent pullback in Nvidia’s stock price might present a valuable buying opportunity.

Evaluating Your Investment in Nvidia

In conclusion, Nvidia’s recent stock performance has been significantly influenced by broader market conditions, including geopolitical risks and industry-specific challenges. Despite this, the company’s strong fundamentals and impressive growth potential make it an intriguing option for investors. Nvidia’s recent price fluctuations might be viewed as part of the natural market cycle, presenting both opportunities and risks.

Loop Capital’s revised price target for Nvidia suggests a potential upside that could be substantial for investors willing to take a long-term view. Ananda Baruah’s optimistic projection of $175 per share indicates confidence in Nvidia’s ability to recover and thrive, driven by its leadership in artificial intelligence and data center technologies. This positive outlook is supported by the company’s recent financial performance, which includes significant revenue and earnings growth.

However, prospective investors should also consider the current expert recommendations and historical performance data before making investment decisions. The Motley Fool Stock Advisor’s recent list of top stocks, which does not include Nvidia, underscores the importance of evaluating a range of investment options. While Nvidia has shown strong historical performance, it is essential to balance this with up-to-date analyses and recommendations from investment experts.

Thorough research is crucial in making informed investment decisions. Investors should assess various factors, including market trends, company performance, and expert opinions. By integrating these elements into their investment strategy, they can make more informed choices and manage their portfolios effectively.

Ultimately, while Nvidia’s stock presents a compelling opportunity, especially given its growth prospects and Loop Capital’s optimistic target, investors should carefully weigh this against other investment options and expert advice. A comprehensive approach, including regular updates from reliable sources like Stock Advisor and careful analysis of historical performance, can help in navigating the complexities of the stock market and achieving investment success.

For the latest in crypto updates, keep tabs on Crypto Data Space.

Leave a Reply