Nvidia Q3 Earnings: Analysts Predict Record Gains Despite Recent Setbacks

A report claiming that the company’s next-generation AI chips have experienced server overheating has put Nvidia’s stock in the limelight Monday, ahead of the artificial intelligence (AI) darling’s quarterly earnings later this week. According to analysts’ average expectations, the AI chipmaker, which is scheduled to post its results after the closing bell on Wednesday, is expected to report that both revenue and profit increased by more than 80% from a year ago. In addition, investors will be keeping an eye on Nvidia’s Blackwell AI chip shipments, as there are worries that supply issues may restrict the company’s short-term growth potential.

Nvidia Shares Face Pressure as Blackwell Chip Performance Scrutinized

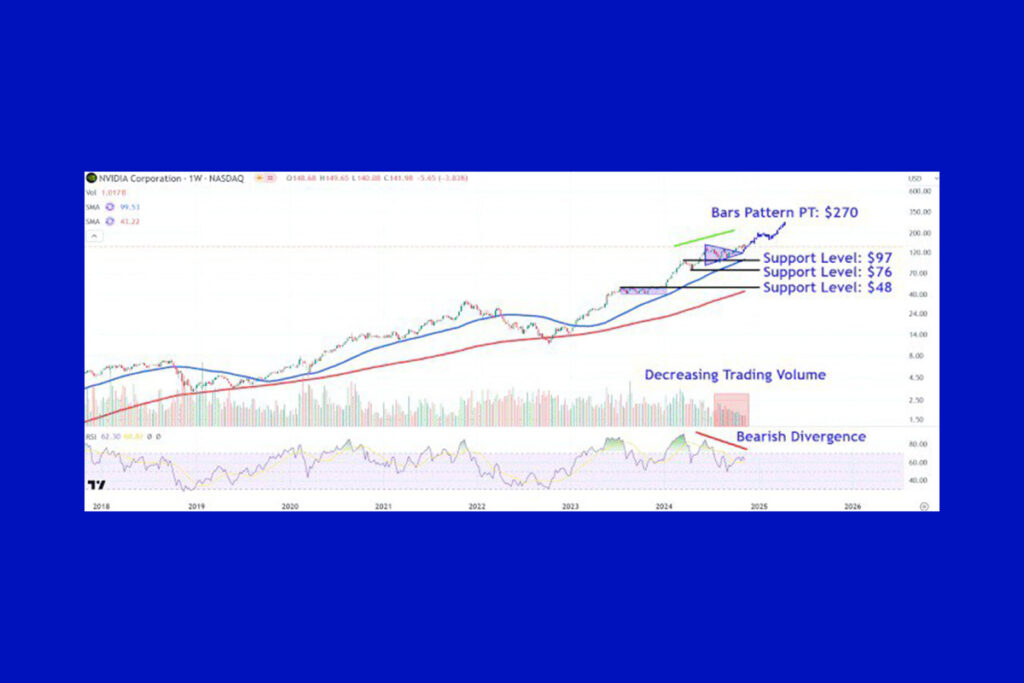

Following a more than 3% decline earlier in the day, Nvidia‘s stock was down 0.7% at $141 in late-morning trade on Monday. Since the beginning of 2024, the stock price has almost tripled. Shares of Nvidia traded in a symmetrical triangle after reaching their June peak, but last month they broke out above the pattern. Though trading volumes have continued to decline, the stock has continued to reach new highs since then, suggesting that larger market participants are not participating in the buying process.

Furthermore, the relative strength index (RSI) has established relatively shorter peaks in response to the stock’s higher peaks since March. This creates a bearish divergence, a chart indicator that indicates diminishing buying momentum. However, when The Information revealed on Sunday that Blackwell chips have experienced overheating issues when installed in server racks that can accommodate up to 72 graphics processing units (GPUs), they may also be the subject of additional examination.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a Reply