Nvidia News – Nvidia’s Earnings Preview: Can the AI Leader Sustain Its 1,200% Growth Surge?

Nvidia News – Wednesday’s fiscal second-quarter earnings report from Nvidia (NVDA) is being hailed as one of the most significant tech earnings reports in years. Nvidia, a leader in artificial intelligence (AI), has demonstrated exceptional growth over the past four quarters, with triple-digit increases in both earnings and sales. Wall Street is eagerly awaiting a continuation of this trend as Nvidia’s stock targets an all-time high while holding steady at its 50-day moving average. The company’s performance could influence other major tech stocks, including Meta Platforms (META) and Apple (AAPL), which are approaching key buy points, while Tesla (TSLA), Alphabet (GOOGL), Microsoft (MSFT), and Amazon.com (AMZN) remain below their 10-week moving averages.

Nvidia’s Impressive Growth and Future Projections

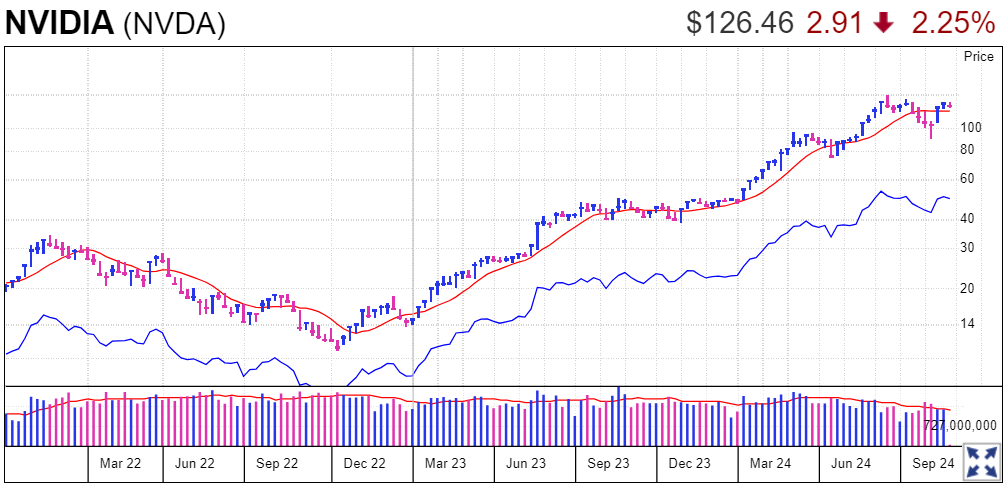

Nvidia has been a standout performer in the tech sector, with its stock experiencing a staggering 1,202% gain from its October 2022 low to its June 2024 high. The company has achieved remarkable growth in earnings, averaging 500% over the past three quarters, with sales growth ranging between 206% and 265%. In its fiscal Q1 report released on May 22, Nvidia reported a 262% increase in revenue to $26 billion and a 455% rise in earnings to 61 cents per share.

For its upcoming Q2 report, analysts are forecasting a 113% increase in sales, reaching $28.7 billion, and a 139% rise in earnings to 65 cents per share. The full fiscal year is expected to see earnings growth of 109%, with projections of $2.72 per share. Nvidia’s revenue is increasingly driven by its AI data center products and services, which have become a major revenue source. CEO Jensen Huang has highlighted that both accelerated computing and generative AI are at a “tipping point,” with AI-related revenue in sectors like finance and healthcare reaching multi-billion-dollar levels.

Nvidia’s Stock Performance and Technical Analysis

Despite the impressive gains, buying Nvidia stock just before earnings can be risky. The stock is currently working on a cup pattern with a buy point at 140.76 and is also eyeing an earlier trendline entry. Nvidia’s ability to recover from a July sell-off and climb back above the 10-week moving average is noteworthy. Although the stock fell over 2% on Monday, it closed above the 50-day line, and its relative strength line has turned upwards, though it is still below a 52-week high.

Investors should be cautious as Nvidia is in a fourth-stage base, which involves higher risks compared to earlier stages. The stock’s remarkable rise over the past years, including a volatile period last month, underscores the importance of managing expectations and risks.

Managing Risk and Investment Strategies

As Nvidia prepares to release its highly anticipated earnings report, investors should have a clear strategy for managing risk. The stock has formed several bases since a first-stage cup in December 2022-January 2023, presenting multiple buying opportunities. Investors should assess whether to increase their positions if the stock breaks out or if they are considering starting a new position, bearing in mind that the stock has already experienced substantial movement.

In conclusion, as all eyes focus on Nvidia’s earnings report, investors should also be attentive to their own risk management strategies and potential investment opportunities. The outcome of Nvidia’s report could have significant implications for the broader tech sector and beyond.

FAQ: Nvidia’s Upcoming Fiscal Q2 Earnings Report

What is the significance of Nvidia’s upcoming earnings report?

Nvidia’s upcoming fiscal Q2 earnings report is highly anticipated because it follows a series of impressive financial performances, including four consecutive quarters of triple-digit growth in earnings and sales. Analysts view this report as a critical indicator of whether Nvidia can sustain its rapid growth trajectory and continue to lead in the AI sector.

What are the expectations for Nvidia’s fiscal Q2 earnings?

Analysts expect Nvidia to report a 113% increase in sales, reaching $28.7 billion, and a 139% jump in earnings to 65 cents per share. For the full fiscal year, predictions include a 109% rise in earnings to $2.72 per share. This anticipated performance follows Nvidia’s recent trend of substantial revenue and earnings growth.

Leave a Reply