Nokia Oyj Shares: Northland Securities Reaffirms Outperform Rating with $6.50 Target

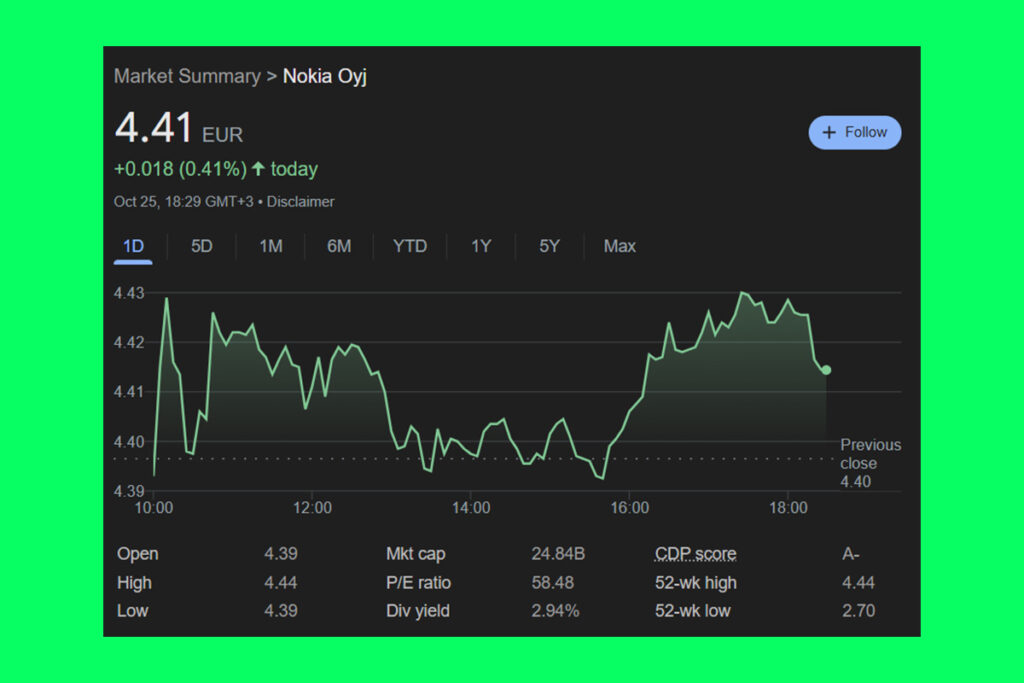

In research released on Friday, October 18th, Northland Securities reiterated its outperform rating and established a $6.50 price target for Nokia Oyj shares. The opening price of Nokia Oyj‘s stock on Friday was $4.78. The company’s debt-to-equity ratio is 0.13, its quick ratio is 1.57, and its current ratio is 1.82. The price of the company has a two-hundred-day moving average of $3.96 and a fifty-day moving average of $4.34. The 52-week low and 52-week high for Nokia Oyj are $2.94 and $4.82, respectively. With a market value of $26.37 billion, the stock’s price-to-earnings-growth ratio is 6.07, its beta is 1.12, and its PE ratio is 29.84.

About Nokia

Globally, Nokia Oyj offers cloud, fixed, and mobile network solutions. The business is divided into four segments: Nokia Technologies, Cloud and Network Services, Mobile Networks, and Network Infrastructure. For residential, mobile, enterprise, and cloud applications, the company offers fixed networking solutions like fiber and copper-based access infrastructure, in-home Wi-Fi, cloud, and virtualization services; IP networking solutions like IP access, aggregation, and edge and core routing; optical networks solutions that offer optical transport networks for long-haul, metro, regional, and subsea applications; and submarine networks for transmission of cables beneath the sea.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a Reply