The Major Factors Driving Nifty 50 and Sensex Growth

Spurred by strong domestic investor support and growing optimism over anticipated rate cuts by the US Federal Reserve and other major global central banks, the Nifty 50 achieved its longest winning streak of 12 sessions on Friday. Sensex recorded advances for the ninth consecutive session, the longest run since September 2023, mirroring this upward momentum as well.

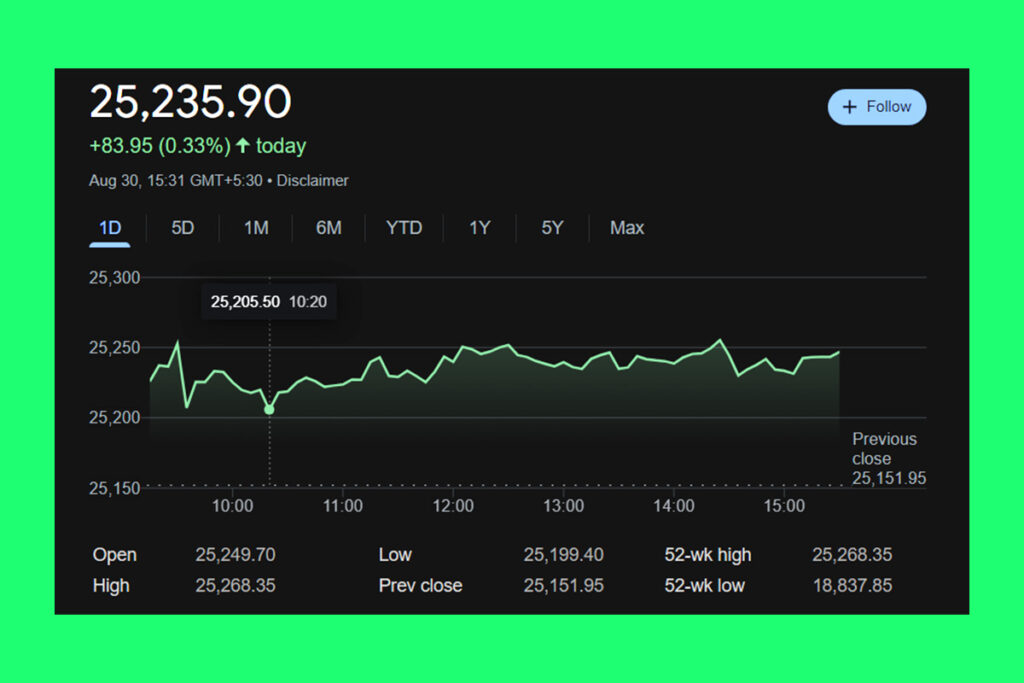

From an intraday and closing perspective, both equities benchmark indices soared to new lifetime highs. Prior to giving up some of its gains to settle at 25,235.9, an 84-point or 0.3% increase, the Nifty 50 hit a new intraday high of 25,268.4. Sensex gained 231 points, or 0.3%, by the end of the day to close at 82,366, its closing value.

Sensex and Nifty 50 Rise in August as DIIs and FPIs Record Significant Share Purchases

The Sensex increased by 1.6% and the Nifty 50 by 1.7% during the course of the week. With the Sensex up 0.8 percent and the Nifty up 1.1 percent in August (the 50-share index had increased by 4.5 percent over the previous 12 sessions), this guaranteed the third consecutive month of gains for both benchmarks.

August saw a strong market performance from domestic institutional investors (DIIs), who net bought shares worth Rs 48,347 crore. Foreign portfolio investors (FPIs) increased their shares by Rs 10,174 crore and were net purchasers as well. Only on Friday, FPIs purchased shares worth a net of Rs 5,318 crore, while DIIs sold shares valued at a net of Rs 3,198 crore. The MSCI India Standard Index was cited as a contributing factor to the FPI inflows.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a Reply