Nasdaq index- Tech-Focused Nasdaq Hits Correction as Equity Market Decline Deepens

Nasdaq index- The Nasdaq Composite Index, heavily weighted with technology stocks, has faced a significant downturn, exacerbated by mounting concerns over tech earnings and a slowing U.S. economy. The index has now fallen 10% below its previous record high, marking its entry into correction territory.

On Friday, the Nasdaq dropped by 2.4% in response to a weaker-than-expected jobs report. This report has raised concerns about whether the Federal Reserve will need to implement substantial interest rate cuts at its next meeting to prevent a potential recession. The recent earnings disappointments from major technology companies, including Amazon (AMZN.O) and Intel (INTC.O), have also contributed to investor unease.

The Nasdaq reached its record closing high of 18,647.45 points on July 10. Since then, it has experienced a 10% decline. In financial terms, a correction occurs when an index or stock falls 10% or more from its most recent peak closing value. This current drop signifies that the Nasdaq has entered correction territory, a state that reflects broader market adjustments following a period of significant gains.

Tom Plumb, CEO and portfolio manager at Plumb Funds, characterized the situation as a classic correction, noting, We’ve transitioned from a growth perception to a scenario where there’s a perceived need for government intervention, particularly through lower interest rates, to stabilize the economy.

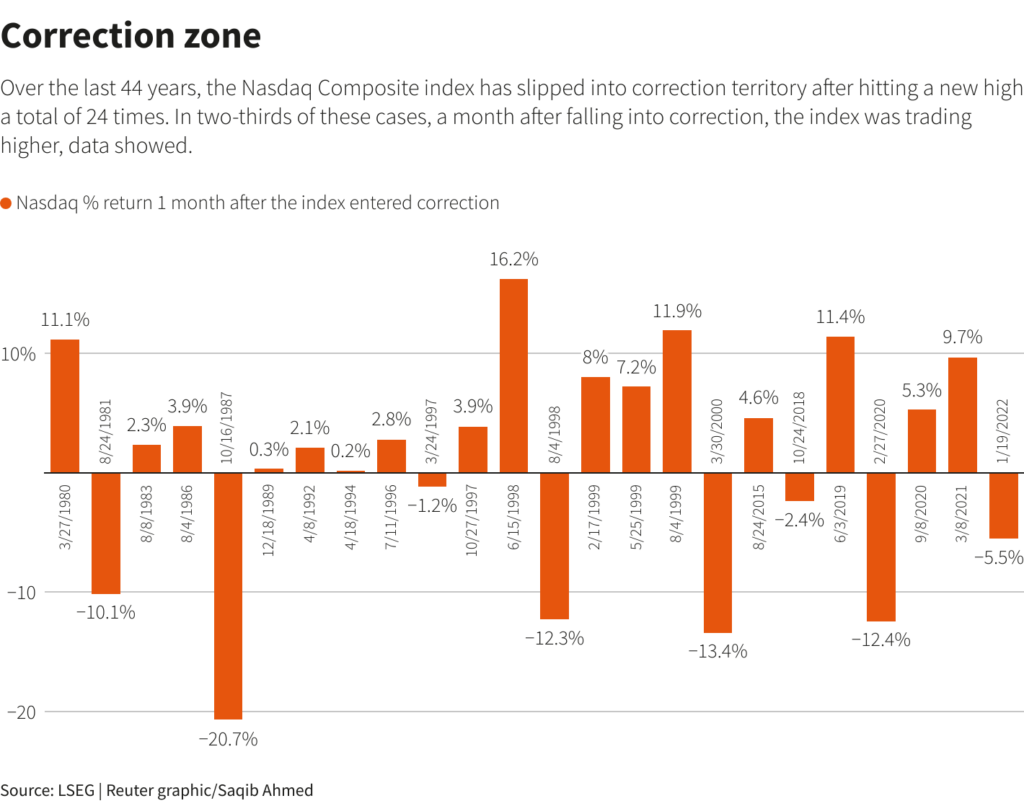

Analyzing historical trends, Reuters found that over the past 44 years, the Nasdaq has entered correction territory 24 times after reaching new highs, averaging roughly once every two years. According to the data, in about two-thirds of these cases, the index has experienced an increase in value within a month following the correction.

The most recent comparable situation occurred on January 19, 2022, when the Nasdaq entered correction mode after achieving a new high. Following this peak, the index’s value plummeted by 36% before eventually reaching its lowest point in December of the same year. This pattern underscores the potential for recovery following a correction, though the timing and extent of such a rebound remain uncertain amidst current economic conditions.

Despite the recent decline, the Nasdaq Composite Index remains up 11.8% year-to-date, reflecting a significant gain over the past seven months. In comparison, the S&P 500, which has experienced a loss of approximately 6% from its peak, shows a slightly higher year-to-date gain of 12.1%. This indicates that both indices have generally performed well over the year, despite recent setbacks.

The recent tumble of the Nasdaq is particularly notable given its role as a leading indicator in the market’s upward trend throughout the year. The decline has been attributed to growing investor caution regarding tech stocks, which have been at the forefront of the market rally, largely driven by enthusiasm for the advancements and potential of artificial intelligence (AI). These highly valued tech stocks, which fueled much of the market’s gains, are now facing increased scrutiny as investors reassess their valuations and future growth prospects.

Additionally, the market is entering what is traditionally considered a challenging period. This phase, often marked by increased volatility and seasonal fluctuations, tends to affect stock performance. Historical patterns suggest that this time of year can be rocky for equities, as market dynamics shift and investors adjust their portfolios in response to changing economic conditions and earnings reports.

Overall, while the Nasdaq’s recent correction reflects short-term uncertainties and investor caution, its year-to-date performance remains strong. The broader market faces a period of potential volatility as it navigates through seasonal trends and reassesses the future outlook for key sectors, particularly technology. As always, investors are advised to stay informed and consider both short-term fluctuations and long-term trends in their investment strategies.

For the latest in crypto updates, keep tabs on Crypto Data Space.

Leave a Reply