Will S And P 500 Inclusion Spark the Next Rally for MicroStrategy and Its Bitcoin Holdings?

With its Bitcoin accumulation strategy and as a stand-in wager for Bitcoin, MicroStrategy, the biggest corporate Bitcoin holder in the world, has seen a huge surge this year. According to market analysts, the MSTR stock is expected to see inflows of $10 billion as it joins the S&P 500 index. This might pave the way for the stock’s next huge surge.

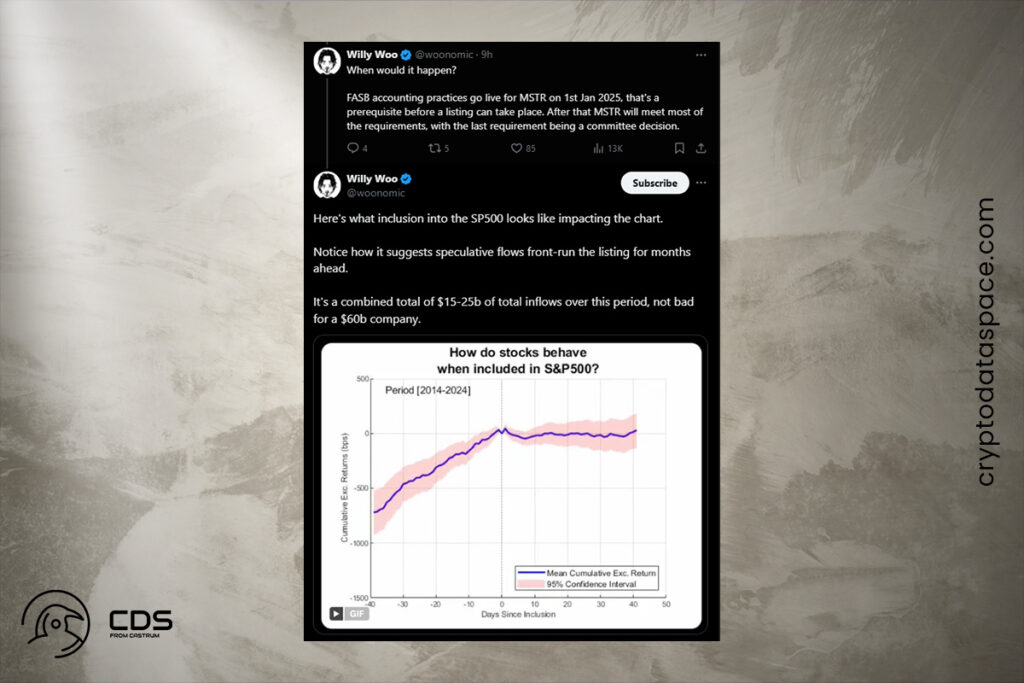

Willy Woo, a well-known cryptocurrency analyst, pointed out that Microstrategy (MSTR) could get large inflows and anticipate a $5–10 billion spike as it prepares to join the S&P 500. At the moment, MSTR is valued at $54.8 billion, which is 2.7 times its $20 billion Bitcoin treasury.

Will MicroStrategy’s S&P 500 Inclusion Spark $15 Billion in Passive Fund Inflows?

Woo anticipates $10–15 billion from passive index-tracker funds and exchange-traded funds (ETFs) shortly after the inclusion. He also anticipates speculative inflows of $5–10 billion. Furthermore, passive index tracking accounts for 20–30% of the $50 trillion market capitalization of the S&P 500. If MSTR is listed in the S&P 500, it will undoubtedly be in a position to profit from the flows.

When the Financial Accounting Standards Board (FASB) modifies accounting regulations in 2025, MicroStrategy will be able to fulfill essential requirements and start its journey to the S&P 500 listing. The S&P committee will have to make a conclusion after FASB compliance goes into effect on January 1.

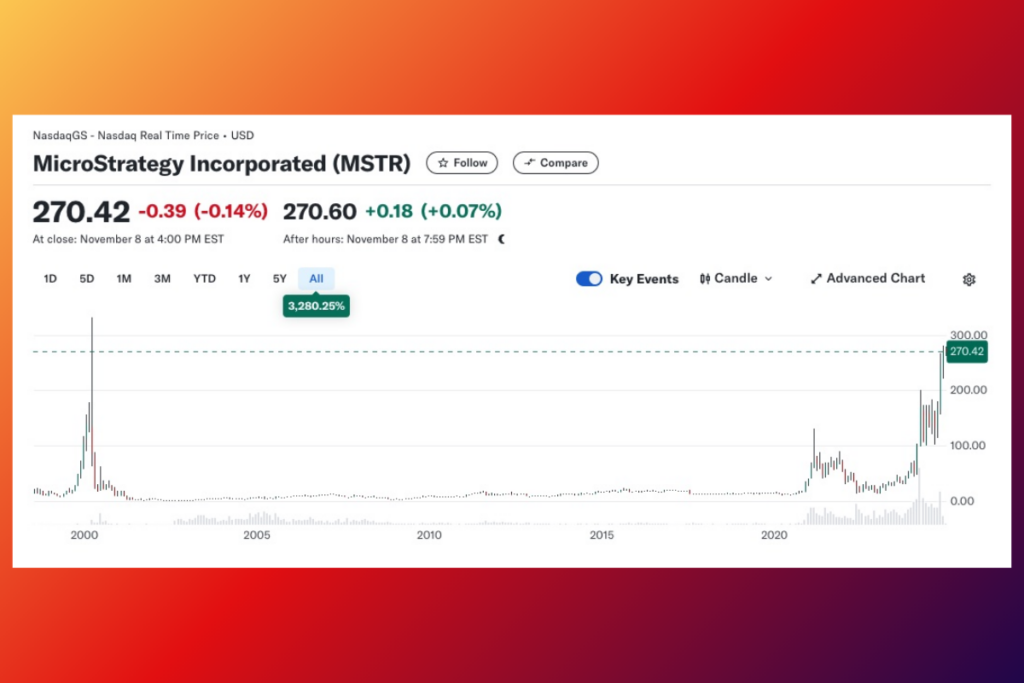

MicroStrategy’s 294% Gain Outpaces Bitcoin and Top Wall Street Giants This Year

MSTR stock has trounced leading Wall Street firms like NVIDIA and even Bitcoin by a significant margin this year, with an astounding 294% return so far. The MSTR stock price is currently trading at $270 levels as of Friday’s closing.

In addition to looking for a subsequent multi-year breakout over the $314 mark, analysts have begun speculating about possible immediate goals of $300. The second rise to $500 during the course of the following year may be set in motion if the bulls are able to produce a strong breakout over $314. With 252,200 Bitcoin holdings now worth $20.54 billion, MicroStrategy has gained 104% on its Bitcoin investment strategy. According to data from Bitcoin Treasuries, the company has acquired 42 Bitcoins at an average acquisition cost of $39,292 per BTC.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a Reply