Microsoft Stock – Microsoft Faces Short-Term Challenges: Why Patience Could Pay Off for Long-Term Investors

Microsoft Stock – Microsoft (MSFT) experienced a significant drop in its market capitalization over the past month, falling by 13.5%. The decline was primarily driven by weaker-than-expected cloud results that overshadowed the company’s otherwise solid earnings performance. Despite this recent downturn, Microsoft’s long-term prospects remain positive due to its diversified business model, continued investments in artificial intelligence (AI), and ongoing initiatives to leverage Azure’s growth in the coming years. As such, it is advisable to view any current dips in Microsoft’s stock as potential buying opportunities.

Strong Fiscal Q4 Earnings Amid Cloud Revenue Disappointment

On July 30, Microsoft reported its Fiscal Q4 earnings, surpassing expectations for the eighth consecutive quarter. The company posted adjusted earnings of $2.95 per share, slightly above the analysts’ forecast of $2.94. This represented a 9.7% increase from the previous year’s earnings of $2.69 per share. Revenue also saw a notable increase of 15% year-over-year, reaching $64.7 billion.

However, despite these positive results, investors were disappointed by the weaker-than-expected growth in cloud revenue. The Intelligent Cloud segment, which includes Azure Cloud, SQL Server, and Windows, reported a year-over-year increase of 19% to $28.5 billion, falling short of expectations and down from the previous quarter’s 23% growth.

Cloud Revenue Growth and Future Outlook

AI remains a critical component of Microsoft’s revenue growth strategy, particularly through its Azure and other cloud services. Nonetheless, Azure’s revenue growth of 29% was below Wall Street’s expectations and a decrease from the previous quarter’s 31% growth. The slower growth has been attributed to challenges in Europe and ongoing capacity constraints, which are expected to persist through the first half of the coming year, though improvements are anticipated later.

Microsoft’s fiscal Q1 outlook projects Azure revenue growth to be between 28% and 29%, slightly below the previous guidance of 30% to 31% for the reported Q4. Despite this, Microsoft forecasts faster Azure growth in the latter half of Fiscal Year 2025 and anticipates double-digit revenue growth for the year, suggesting a positive long-term trajectory.

AI Investments Drive Long-Term Potential

Microsoft’s early investments in AI have positioned it as a global leader in the field. The company’s timely partnership with OpenAI’s ChatGPT and increased capital expenditures in AI have contributed to its status as one of the most valuable companies worldwide. AI investments are driving revenue across various segments, including Azure, GitHub, Copilot, and Office suites. While Azure trails behind Amazon’s AWS in market share, it has significantly gained ground, now holding a 25% share of the cloud industry compared to 19% three years ago.

Despite a slowdown in Azure revenue growth, driven by increased capital investments ($19 billion in Q4, up from $14 billion in the previous quarter), Microsoft’s strategic focus on AI and cloud services remains strong. Competitors like Google and Meta Platforms are also heavily investing in AI, signaling a broader industry trend.

Valuation and Analyst Recommendations

Microsoft’s valuation, trading at a forward P/E ratio of 30x, may initially appear high. However, this premium is justified given the company’s leading market position, strong margins, and substantial exposure to high-growth AI and cloud sectors. In comparison, Amazon’s P/E is 34.3x, and Apple’s is 31.5x.

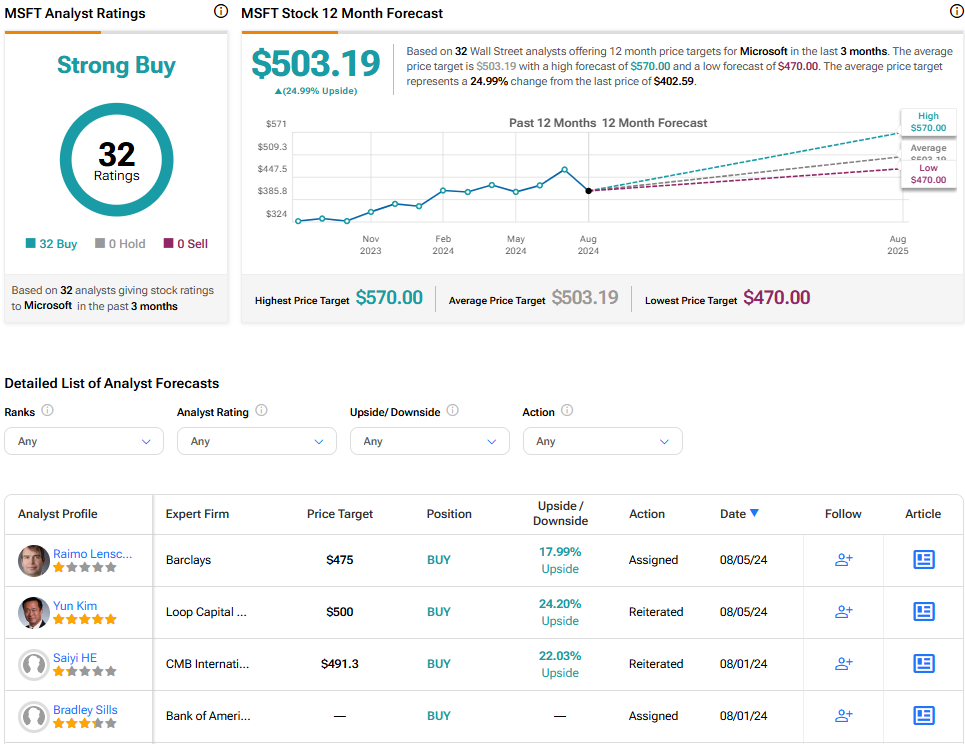

Wall Street analysts maintain a bullish outlook on Microsoft stock, with a consensus Strong Buy rating. The average price target for MSFT is $503.19, suggesting a potential upside of 25% from current levels.

Long-Term Investment Perspective

While Microsoft may face near-term challenges due to slower cloud revenue growth, its long-term prospects remain robust. Azure’s growth, bolstered by AI advancements, is expected to accelerate in the latter half of Fiscal Year 2025. Investors are advised to consider MSFT stock as a buy, particularly during market dips, to capitalize on the company’s sustained growth potential.

For the latest in crypto updates, keep tabs on Crypto Data Space.

Leave a Reply