MCD Stock Performance – Bullish Outlook for McDonald’s Ahead of Q3 Earnings

MCD Stock Performance – As earnings season approaches, investors are keen to analyze key players in the fast-food industry. This article utilizes the TipRanks Stock Comparison Tool to evaluate McDonald’s (MCD) and Starbucks (SBUX), with their earnings reports scheduled for October 29 and October 30, respectively. While both chains face softer comparisons this quarter, a deeper dive suggests a bullish outlook for McDonald’s due to its value-oriented strategies, while a neutral stance on Starbucks is warranted given its uncertain long-term guidance amid a C-suite transition.

McDonald’s Latest Earnings Recap

I maintain a bullish rating for McDonald’s, despite a disappointing June quarter where the company missed both revenue and earnings expectations for the second consecutive time. Earlier this year, McDonald’s highlighted a trend of increased selectivity among consumers, particularly within the lower-income demographic. In the second quarter, management noted that these pressures had deepened, affecting a broader consumer base.

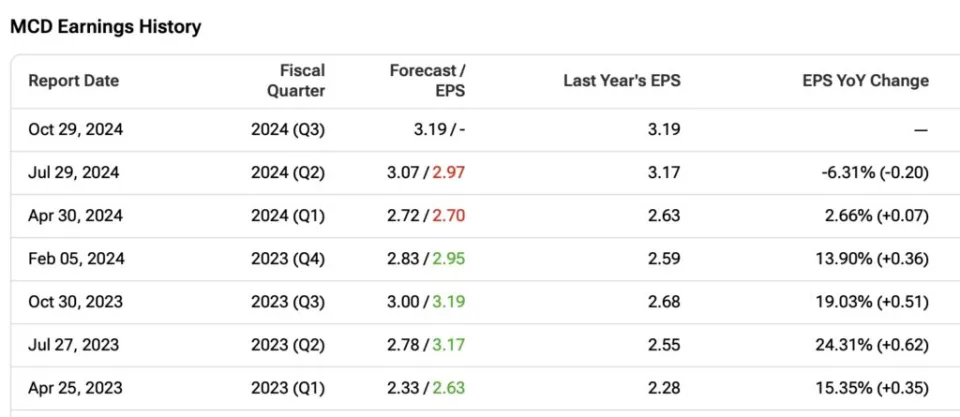

McDonald’s reported an adjusted EPS of $2.97 in Q2, falling short of estimates of $3.07, marking its largest miss since January 2022. Revenues came in at $6.49 billion, below the forecast of $6.6 billion. Same-store sales declined across all divisions, resulting in an overall drop of 1%, contrary to expectations of a 0.4% gain. This marked the first decline in company-wide same-store sales since Q4 2020.

Despite these negative Q2 results, McDonald’s stock has risen over 20% in the past three months, outperforming the S&P 500 (SPX). This market reaction can be attributed to initiatives focused on enhancing the perception of value, particularly through the $5 Meal Deal, which targets lower-income households. Additionally, the company is innovating its core menu to capture market share in chicken and beef, while also expanding its loyalty membership program.

What to Expect Ahead of MCD’s Q3 Earnings

I remain bullish on McDonald’s leading up to its Q3 report. The company will benefit from easier comparisons this quarter, as most Wall Street analysts have adjusted their revenue and EPS estimates downward. To surpass expectations for Q3, McDonald’s needs to report over $3.19 in EPS (a 0.1% year-over-year increase) and $6.80 billion in revenue (a 1.7% year-over-year increase).

While beating or missing estimates does not always dictate stock movement—as evidenced in Q2—the positive reaction that followed that quarter was largely attributed to management’s confident tone regarding their plans to reestablish value leadership. Therefore, progress toward these expectations should be the primary factor influencing the stock price.

As earnings season unfolds, McDonald’s appears poised for a strong showing thanks to its strategic focus on value and menu innovation. Conversely, Starbucks faces uncertainty due to executive transitions that may impact its long-term guidance. Investors will be closely monitoring these developments to gauge the future performance of both companies.

Frequently Asked Questions (FAQ)

What are the earnings dates for McDonald’s and Starbucks?

McDonald’s is scheduled to release its earnings report on October 29, while Starbucks will follow with its report on October 30.

What factors are affecting McDonald’s performance this quarter?

McDonald’s is facing softer comparisons due to increased selectivity among consumers, particularly among lower-income groups. Despite a weak June quarter, the company has implemented value-oriented initiatives that are expected to bolster performance.

How did McDonald’s perform in the last quarter?

In the second quarter, McDonald’s reported an adjusted EPS of $2.97, missing estimates of $3.07. Revenues were $6.49 billion, below the expected $6.6 billion, and same-store sales declined by 1%, marking the first decline since Q4 2020.

What is the outlook for McDonald’s stock ahead of earnings?

Analysts maintain a bullish outlook for McDonald’s, anticipating easier comparisons this quarter. The company needs to report over $3.19 in EPS and $6.80 billion in revenue to meet expectations.

Leave a Reply