Positive Earnings and Green Initiatives: Latest Rolls-Royce Achievements

Aero-engine manufacturer Rolls-Royce experienced a 132.5% price increase in the last year. Accordingly, it may seem like a company to approach cautiously, especially given the ongoing uncertainty in major global economies and the shaky state of financial markets. However, it isn’t. At the beginning of 2020, just before the pandemic, it was trading at 45% higher than its current levels. Its large civil aerospace area, in particular, was severely impacted by COVID-19, which completely destroyed its momentum.

However, it has since rebounded, and if it continues on its current path, a large price increase is still possible, particularly so considering that its first half (H1 2024) results earlier this month demonstrated how strong its finances are.

- Despite having increased by 132.5 percent in the last year, Rolls-Royce’s stock is still trading much below its levels prior to the pandemic, suggesting that it may rise even more.

- A robust H1 2024 sales growth, enhanced profit margins, and an updated profit outlook all contribute to the price support.

3 Key Points in the Financial Performance

If Rolls-Royce’s latest financial performance is to be analyzed, 3 prominent headlines are likely to please investors.

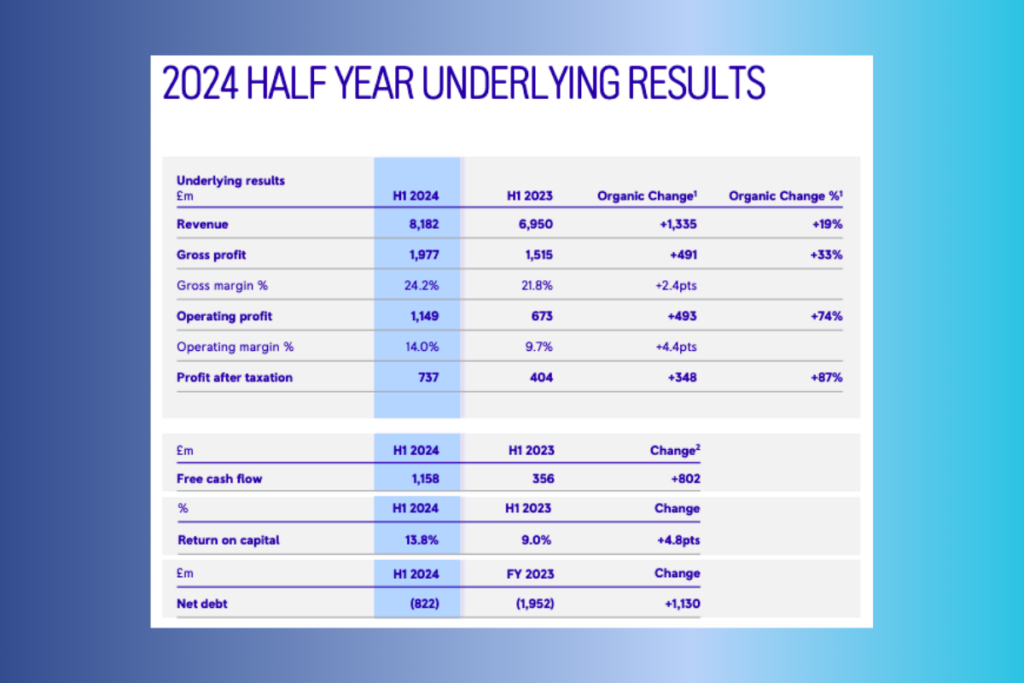

- Healthy Revenue Growth: In H1 2024, its underlying revenue growth of 19% year over year (YoY) is still solid, despite a modest slowdown from the 21% observed in 2023.

- Margins Increase: The profit margins increased in 2023, with the operating margin rising to 14% from 10.3% the previous year and the gross margin increasing to 24% from 21% for the whole year. This was due to even faster profit growth than revenue growth.

- Improved Outlook: Rolls-Royce raised its operational profit forecast as well. From an earlier range of GBP 1.7-2 billion, it now anticipates the underlying amount to range between GBP 2.1-2.3 billion, a 19% rise at the midpoint.

Rolls-Royce to Resume Dividends in 2024 with Focus on Decarbonization

However, when it comes to stock metrics, dividends should be taken into consideration first. Rolls-Royce will also resume paying dividends after five years. It projects that in 2024, the dividend payment ratio will be 30% of the underlying post-tax earnings and that it will then range between 30 and 40%.

Additionally, the organization is focusing on the green economy and the future. Prioritizing decarbonization, the corporation wants to achieve net-zero emissions from its operations by 2030. With a 40% decrease in greenhouse gas emissions [GHGs] during the previous ten years, it has already made headway in this direction. However, there’s much more, including significant recent advancements that help advance efforts to achieve the worldwide targets for net-zero emissions.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a Reply