Latest Crypto News What Effects Crypto Prices in July: Ether ETFs in Focus and Messi’s Memecoin Endorsement: Hodler’s Digest, July 7-13

Latest Crypto News What Effects Crypto Prices in July – Discover the latest in crypto with updates on Ether ETFs, Messi’s promotion of a new memecoin, and much more.

Updated Ether ETF Filings by VanEck and 21Shares

On July 8, asset managers VanEck and 21Shares updated their S-1 filings for Ether exchange-traded funds (ETFs) with the U.S. Securities and Exchange Commission (SEC). Although a precise launch date wasn’t provided, industry experts anticipate a potential launch within July, marking a significant step in Ethereum investment products. This development follows a trend of increasing interest in blockchain-based financial instruments, signaling a growing mainstream acceptance of cryptocurrency investments.

Lionel Messi Promotes Solana-Based Memecoin

Football legend Lionel Messi drew attention by promoting WaterCoin on his Instagram stories. This memecoin, built on the Solana blockchain, claims to support water conservation initiatives and aims to evolve into an ecological digital currency. However, investing in memecoins can be highly risky. Conduct thorough research before making any investments. WaterCoin’s endorsement by such a high-profile figure underscores the blending of celebrity influence and cryptocurrency marketing, yet it is crucial to remain vigilant about the volatility and speculative nature of such investments.

Bitcoin Transfer Fees Drop to 2020 Levels

On July 7, Bitcoin’s average transfer fee fell to $38.69, levels not seen since 2020. This metric, calculated by dividing miner earnings by the total number of blockchain transactions, indicates reduced costs. CryptoQuant’s latest data also show a decrease in the Bitcoin hashrate, reminiscent of December 2022, suggesting potential shifts in mining operations. This drop in transfer fees could make Bitcoin more attractive for daily transactions, potentially boosting its adoption for everyday use.

Goldman Sachs Eyes Tokenization with New Products

Goldman Sachs plans to introduce three new tokenized products this year, targeting both the U.S. and European markets. Matthew McDermott, Goldman’s global head of digital assets, revealed that the firm aims to develop an institutional marketplace for trading tokenized real-world assets (RWA). This move underscores Goldman Sachs’ increasing involvement in the tokenization industry. Tokenization, which refers to the process of creating a digital representation of a real-world asset on a blockchain, is seen as a significant step towards enhancing liquidity, transparency, and accessibility in traditional markets.

FDIC Nominee Advocates for Crypto Custody

During a nomination hearing on July 11, Christy Goldsmith Romero, nominee for the chair of the Federal Deposit Insurance Corporation (FDIC), supported the notion that banks should be allowed to custody digital assets. Her statement, in response to Senator Cynthia Lummis, highlights a growing acceptance of crypto within traditional financial institutions. This perspective aligns with the broader regulatory trend towards integrating digital assets into the financial system, potentially paving the way for more secure and regulated crypto custody solutions.

Stay Updated: Keep informed about the latest crypto news and catch the market flow.

Crypto Market Overview

As of this week, Bitcoin (BTC) is priced at $58,192, Ether (ETH) at $3,132, and XRP at $0.46, bringing the total market capitalization to $2.15 trillion, according to CoinMarketCap. These figures reflect the ongoing volatility and dynamic nature of the cryptocurrency market, influenced by a multitude of factors including regulatory developments, market sentiment, and technological advancements.

Top Performing Altcoins and Declining Altcoins

Among the top 100 cryptocurrencies, the biggest gainers were Notcoin (NOT) up by 45.33%, Mantra (OM) rising 37.23%, and Celestia (TIA) increasing by 30.36%. On the flip side, Dogwifhat (WIF) dropped by 19.71%, Brett (Based) (BRETT) fell by 9.33%, and Flare (FLR) declined by 7.33%. These movements highlight the highly speculative nature of altcoins, driven by factors such as market hype, project developments, and investor sentiment.

Memorable Quotes of Crypto

Ethereum has unique strengths as a robust base layer, including some that are not even held by Bitcoin.”

Vitalik Buterin, co-founder of Ethereum

If the Commission moves forward with its proposed amendments, a reviewing court […] is certain to conclude that the Commission’s interpretation of the Exchange Act stretches the statutory text too far.”

Although [Trump] has recently had a change of heart on cryptocurrency, you [President Biden] still have an opportunity to provide the regulatory clarity that voters are calling for.”

Things that many of us who have been in the industry have become used to, paying for gas, having a native token. […] That’s not a normal sort of set of logic when you’re trying to pay for a cup of coffee.”

Chintan Turakhia, senior director of engineering at Coinbase

Nothing gets the SEC to act faster than shilling a memecoin.”

David Chung, founding director at Creo Legal

AI and memecoins captured the spotlight [in 2024], pushing GameFi down the pecking order.”

Russell Bennett, CEO of Metacade

Bitcoin’s Market Outlook: Summer Crypto Correction Predicted

Crypto Prediction of the Week

Bitcoin Price Faces Major ‘Summer of 2021’ Style Correction Despite Whale Accumulation

Bitcoin may experience a significant correction reminiscent of Summer 2021, as indicated by a recent CryptoQuant report. Analyzing the Profit & Loss metric, the report shows that Bitcoin’s index is closely aligned with its 365-day moving average, signaling a potential downturn.

Despite continued accumulation by Bitcoin whales, the market faces selling pressure from the German government’s Bitcoin sell-off and the Mt. Gox reimbursement plan. These factors contribute to a challenging environment for Bitcoin’s price stability.

Additionally, CryptoQuant’s Bull-Bear indicator suggests a bearish market sentiment, showing signs of breaking below the neutral line. This indicates that bears may be gaining control, which could lead to a steeper correction.

Bitcoin’s trading behavior around the 200-day simple moving average further highlights its current price weakness. Sustained trading below this key average often signals broader market challenges, underscoring the potential for continued price declines. Investors should remain cautious and stay informed about market trends and external influences impacting Bitcoin’s performance.

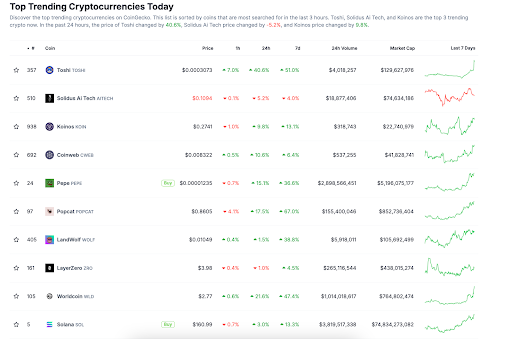

Top 10 Trending Crypto Today

FUD Highlights of the Week

Paxful Co-founder Faces Legal Challenges

Artur Schaback, Paxful’s co-founder, faces a five-year prison sentence after pleading guilty to AML violations and failing to implement KYC procedures. Additionally, he must pay $5 million in fines and resign from the Paxos board, with sentencing scheduled for November 4, 2024. This case underscores the critical importance of adhering to regulatory requirements in the crypto space to avoid severe legal repercussions.

German Government’s Bitcoin Sale Impact

The German government is preparing to liquidate $342 million worth of Bitcoin, contributing to market volatility. The sale, combined with the $9 billion Mt. Gox reimbursement, keeps investors on edge as Bitcoin struggles below its 200-day EMA. Such large-scale sell-offs by governments or institutional entities can significantly impact market dynamics, leading to increased volatility and potential price drops.

Security Breach at Compound Finance

On July 11, 2024, blockchain investigator ZachXBT reported a potential security breach at Compound Finance. The exploit redirected users to a phishing site, posing significant risks. Compound Finance confirmed the breach and advised users to avoid the site temporarily. This incident highlights the ongoing security challenges in the DeFi space and the need for robust security measures to protect users and assets.

THIS WEEK TREND CRYPTO NEWS

THIS WEEK TREND CRYPTO NEWS

PEPE Coin News – BitMEX Introduces MEMEMEXTUSDT: A New Basket Index Perpetual Swap Contract

BTC Price Analysis: Understanding Bitcoin Market Sentiment After Price Increase

Ethereum Price Analysis: What Factors Are Preventing Ether Price from Rising?

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a Reply