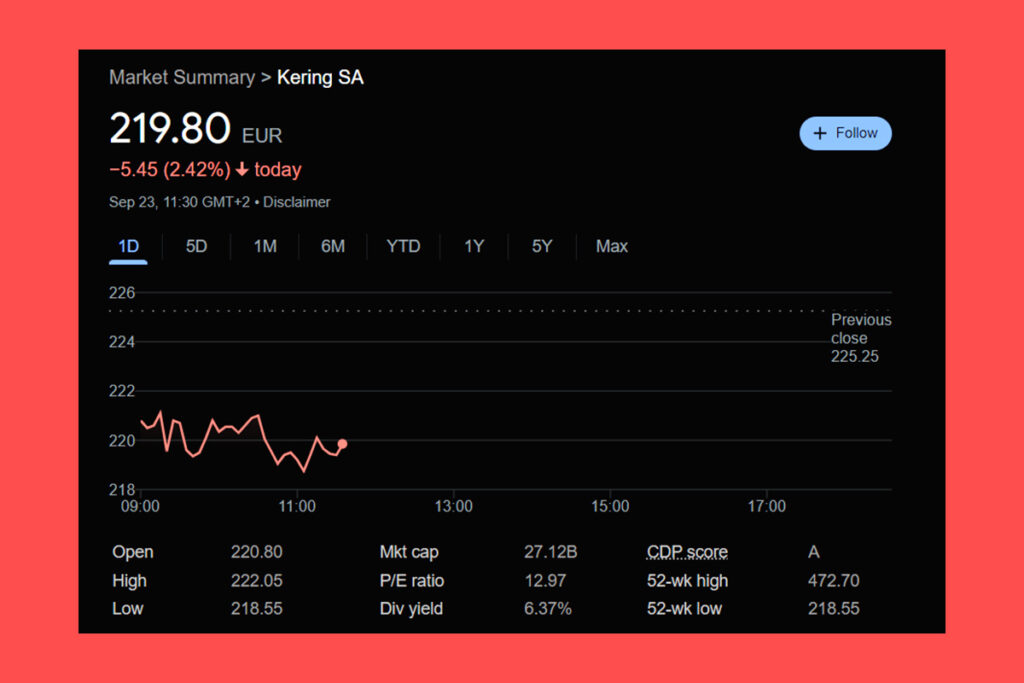

Kering Sales Decline as Gucci Turnaround Timeline Extends to 2026

With Gucci’s turnaround expected to take an additional two to three years, Morgan Stanley looks at Kering and predicts that the French luxury behemoth will continue to underperform. In the second quarter, Kering, which is most known for its Gucci brand, reported an 11% year-over-year decline in overall sales on a constant currency basis. Gucci’s revenue fell 20% year over year to €4.1 billion in the first half of 2024, a sharp dip mainly caused by a 20% decline in directly operated retail sales.

Morgan Stanley Cuts Gucci’s 2024 Sales Projections Amid Weak Chinese Demand

The bank lowers its top-line projections for Gucci in the third and fourth quarters of 2024 because of a decline in Chinese demand both domestically and overseas.

We revisit our estimates on Kering and cut 2024 and 2025 EPS by 5% and 6% respectively. Our channel checks over the summer indicated no change in brand momentum at Gucci and continued underperformance vs. peers. The brand has launched one key novelty handbag line ‘Emblem’ in September and has a few more planned for Q4. We believe if successful, there is usually some lag between launch and sales picking up.

analysts at Morgan Stanley

While keeping an equal-weight rating on Kering, Morgan Stanley lowered its 12-month target price from €310 to €265. The bank stated that the management’s FY24 guidance was given in the middle of July, prior to trends becoming noticeably worse.

Hence we sit below company guidance on 2H24 with sales -8% and EBIT -35% (vs. guidance for EBIT -30%). Contacts in China we have spoken to recently believe Gucci’s turnaround will likely take another 2-3 years,

the bank

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a Reply