FTSE 100 news- August Trading Begins with Stocks Falling as Data Fuels Economic Slowdown Fears

FTSE 100 news- U.S. stocks began August with a significant downturn following the release of economic data on Thursday, which raised concerns about a potential and faster-than-expected economic slowdown, coupled with the Federal Reserve’s continued restrictive monetary policy stance.

Initially, the stock market showed some positive momentum at the open, partly driven by Meta Platforms (META.O), which reported quarterly results that surpassed analysts’ expectations. The company’s upbeat guidance for the third quarter also contributed to the initial gains. Meta’s shares surged by 5.87%, making it the largest contributor to the S&P 500’s early rise. However, these gains were short-lived as the market reacted to subsequent economic data.

The mood on Wall Street shifted abruptly after data revealed a sharp decline in manufacturing activity. According to the Institute for Supply Management (ISM), the manufacturing index plummeted to 46.8 in July, marking its lowest level in eight months. This significant drop is indicative of a contraction in the manufacturing sector, which has raised alarms about the health of the broader economy.

Lou Basenese, the president and chief market strategist at MDB Capital, highlighted the growing concern that the Federal Reserve might be lagging in its policy measures. It raises a genuine fear that the Fed is behind on cutting rates, Basenese noted. He elaborated that the prevailing sentiment among investors is one of skepticism regarding the Fed’s ability to achieve a smooth economic transition, often referred to as a ‘soft landing’. The recent data appears to validate these fears, reinforcing the sense of unease among market participants.

The impact on the stock market was pronounced. The Dow Jones Industrial Average (.DJI) fell sharply by 494.82 points, or 1.21%, ending the day at 40,347.97. The S&P 500 (.SPX) lost 75.62 points, or 1.37%, closing at 5,446.68. The Nasdaq Composite (.IXIC) experienced the largest drop, declining by 405.25 points, or 2.30%, to settle at 17,194.15. Historically, August tends to be one of the weaker months for stocks, which likely exacerbated the negative reaction to the economic data.

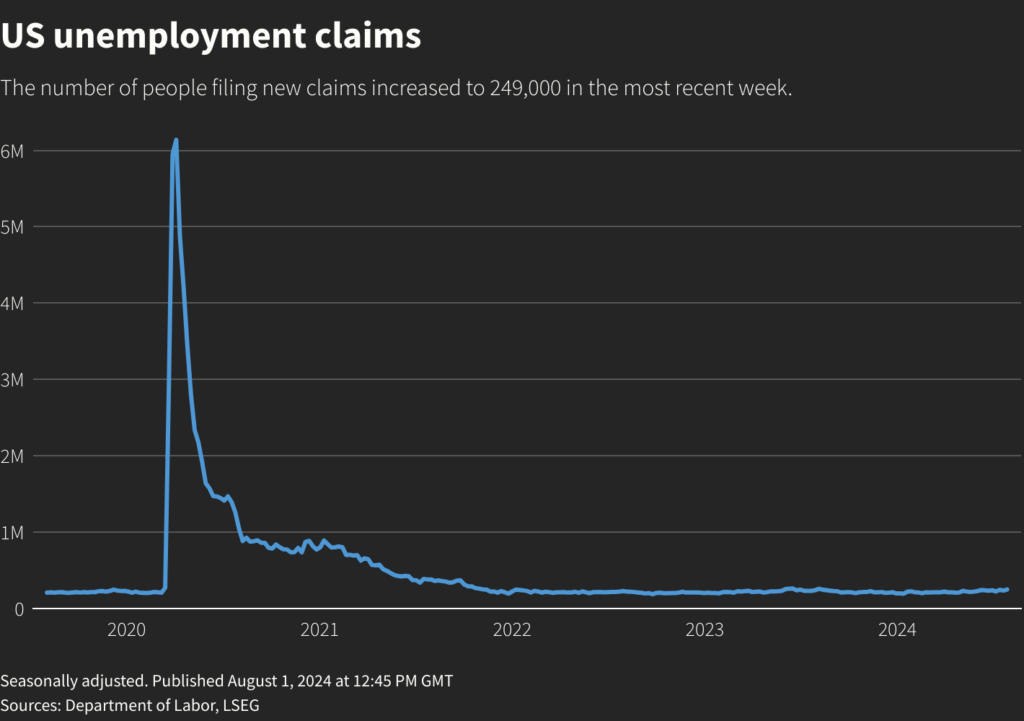

In addition to the manufacturing data, reports also indicated a notable increase in new applications for unemployment benefits, reaching an 11-month high last week. This rise suggests some softening in the labor market, although it is important to consider that seasonal factors might also be influencing these figures.

Investors are now looking ahead to the government’s payrolls report scheduled for Friday. This report is expected to provide further insights into labor market conditions and may influence market sentiment and future policy decisions. The anticipation of this report reflects the ongoing uncertainty and the market’s sensitivity to any signs of economic weakness or strength. As such, it will be a critical focus for investors trying to navigate the current volatile economic environment.

In the previous session, both the S&P 500 and Nasdaq experienced their largest daily percentage gains since February, driven by a notable rally in chip stocks after the Federal Reserve held interest rates steady, which was in line with market expectations. The rally was also supported by positive sentiment in defensive sectors such as utilities and real estate, which saw significant gains. These sectors benefited from geopolitical tensions in the Middle East, which strengthened the dollar and led to lower Treasury yields.

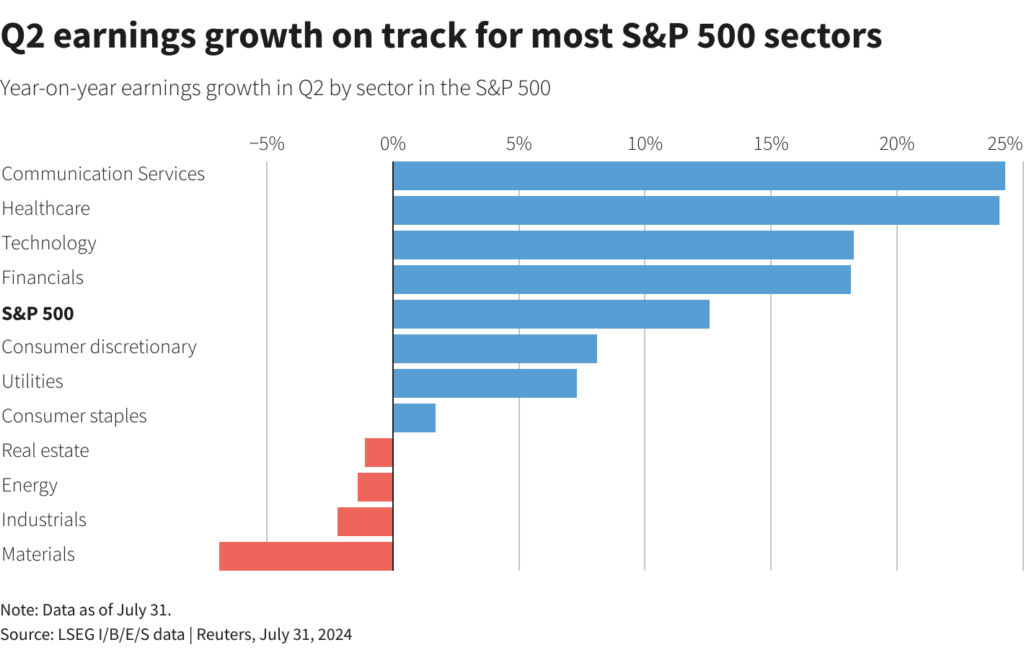

Conversely, the decline in major technology stocks, including Apple and Amazon, weighed heavily on the performance of technology and consumer discretionary indexes. Apple saw a drop of 1.68%, while Amazon fell by 1.56% ahead of its quarterly earnings results, which are scheduled to be released after the market close. This decline in large-cap tech stocks contributed to the tech and consumer discretionary sectors being among the worst performers of the 11 major S&P 500 sectors.

After the market closed, Amazon’s shares suffered a further decline of 4.47% following the announcement of its quarterly results and outlook. This decline added to the pressure on the tech sector, which had already been underperforming due to broader market dynamics.

Small-Cap Stocks Plunge and Tech Sector Faces Turmoil Amid Market Volatility

The small-cap Russell 2000 index (.RUT) experienced a sharp decline of 3.03%, marking its largest daily percentage drop since February 13. This downturn in small-cap stocks reflects recent market volatility, as investors shift between undervalued and overvalued stocks. Small caps, which are particularly sensitive to economic conditions, have been under pressure as concerns about the broader economic environment persist.

Steve Sosnick, a market strategist at Interactive Brokers in Greenwich, Connecticut, commented, Without a strong economy, these economically sensitive small stocks just won’t perform well, even with potential rate cuts. His remarks highlight the challenges faced by small-cap stocks amid ongoing economic uncertainty.

In the broader technology sector, Nvidia (NVDA.O) saw a significant drop of 6.67% as part of a wider selloff in chip stocks. This decline was triggered by Arm Holdings’ cautious revenue forecast and Qualcomm’s (QCOM.O) warning about revenue impacts due to trade restrictions. Arm’s shares plummeted 15.72%, and Qualcomm’s stock fell 9.37%. The PHLX Semiconductor Index (.SOX) also suffered, losing 7.14% in its biggest daily percentage drop since March 2020.

Moderna (MRNA.O) faced a steep decline of 21.01% after it reduced its 2024 sales forecast for COVID-19 and respiratory syncytial virus (RSV) vaccines by up to 25%. This significant cut in forecasts has led to a sharp market reaction.

On a positive note, Eli Lilly (LLY.N) saw a rise of 3.5% after promising trial results for its weight-loss drug Zepbound. The drug was found to reduce the risk of hospitalization, death, and other adverse outcomes in obese adults with a common type of heart failure.

Market breadth was decidedly negative, with declining issues outnumbering advancers by a ratio of 2.04-to-1 on the NYSE and 3.19-to-1 on the Nasdaq. Additionally, the S&P 500 recorded 54 new 52-week highs and seven new lows, while the Nasdaq Composite saw 65 new highs and 177 new lows.

For the latest in crypto updates, keep tabs on Crypto Data Space.

Leave a Reply