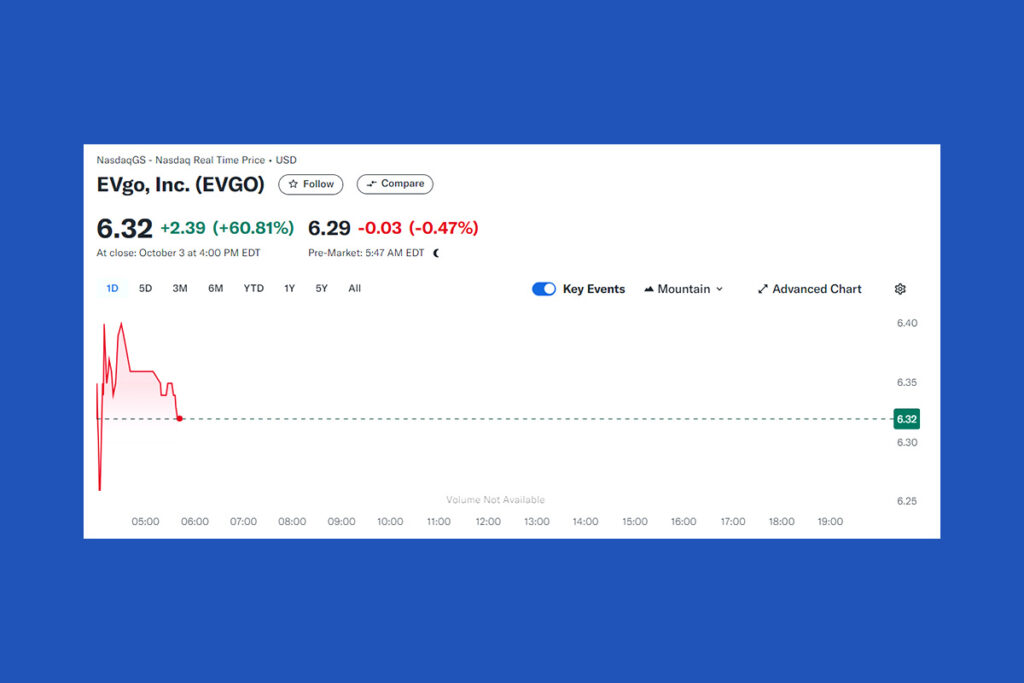

Electric Vehicle Infrastructure Powers EVgo Shares to 52-Week High of $5.09

Reviving the market with a 52-week high of $5.09 is EVgo Inc., a prominent electric vehicle charging network. An increased focus on climate change activities has contributed to investor confidence in the electric vehicle (EV) market, as evidenced by this spike.

The Climate Change Crisis I index has significantly increased over the last year, with a 1-year change of 24.76%, indicating a strong investor appetite for projects that consider the environment. The market’s realization of how important infrastructure for electric vehicles is to the shift to a greener economy is demonstrated by EVgo’s performance.

EVgo’s Expansion Gains Momentum with $1.05 Billion Loan and 32% Revenue Growth

The US Department of Energy has conditionally committed to a $1.05 billion loan guarantee for EVgo, a well-known public rapid charging network for electric vehicles. By 2030, this funding should make it possible to build about 7,500 additional DC fast charging stations. Moreover, with over three decades of experience in both finance and operations, Paul Dobson was recently named as EVgo’s new Chief Financial Officer.

Also, in collaboration with General Motors, EVgo has revealed intentions to construct 400 additional rapid charging stations around the US. Revenue increased by 32% year over year and surpassed $66 million, according to the company’s latest financial performance. Cantor Fitzgerald raised its price objective for EVgo’s shares to $5.00, while Stifel analysts kept their buy ratings for the company. Both analysts have good outlooks for EVgo.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a Reply