DocuSign Q2 Earnings Soar Above Expectations as Website Traffic Spikes by 18.52%

After the electronic signature company published its second-quarter earnings for Fiscal Year 2025, DocuSign’s shares increased in after-hours trading. Above the analysts’ consensus estimate of $0.81 per share, earnings per share came in at $0.97. Income reached $736 million, a 7% rise in sales over the previous year. This exceeded the $727.8 million analysts had predicted. Growing by 7% to account for $717.4 million of total sales, subscription revenue was the primary driver of growth.

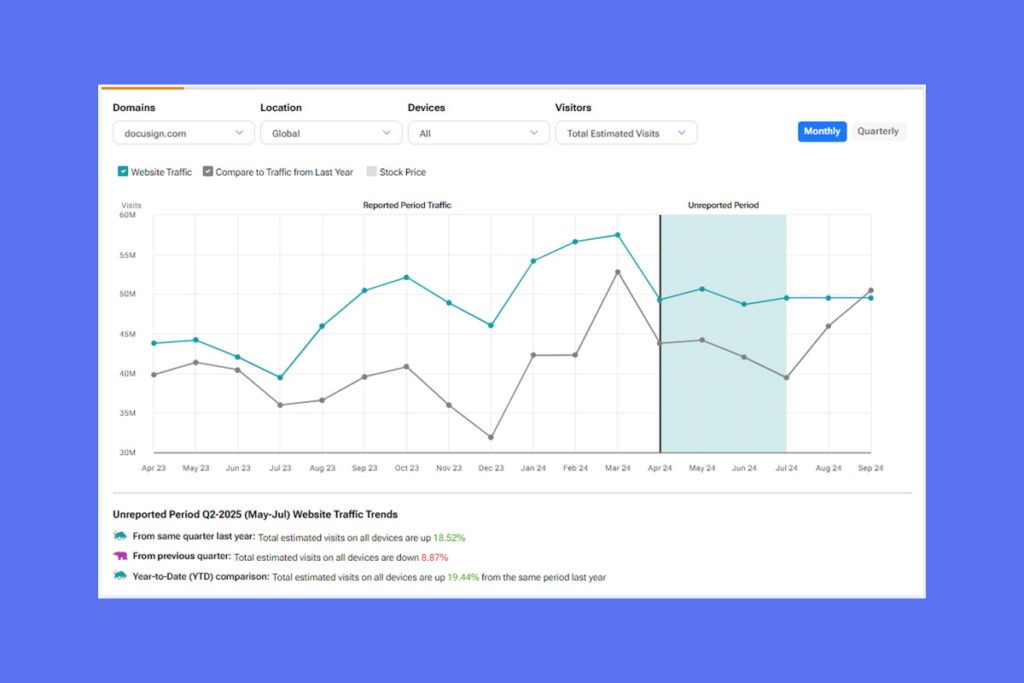

Conversely, professional services and other revenue reached $18.7 million, up 2% from the previous year. Surprisingly, investors only needed to glance at DocuSign‘s website traffic to predict the company’s strong performance. The image above illustrates how visitor numbers increased in the most recent quarter. Comparing the same quarter of last year to this one, the total projected visitors actually increased by 18.52%.

Wall Street Analysts: DocuSign’s FY 2025 Guidance Suggests 11% Upside, But ‘Hold’ Rating Stays

Looking at Wall Street, analysts have assigned three Buys, nine Holds, and two Sells to DOCU stock over the last three months, resulting in a consensus rating of Hold. The average price estimate of $63 per share for DOCU indicates an 11.07% upside potential following a 7.5% increase in share price over the previous year. It’s important to remember, though, that forecasts will probably alter in light of today’s results release. With an eye toward the future, management has offered the following guidance for FY 2025:

- Revenue of between $2,940 million and $2,952 million as opposed to the $2,928 million analysts had predicted

- Operating margin that is not GAAP, between 29% and 29.5%

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a Reply