Delivery Hero Shares Soar, but Are Investors Missing a Hidden Opportunity?

The 31% increase in share price over the past month will undoubtedly excite Delivery Hero‘s shareholders, even though the company is still having difficulty regaining ground that it has lost recently. Regretfully, the recent gains were insufficient to offset the losses incurred during the previous year, as the stock fell by 22% during that period.

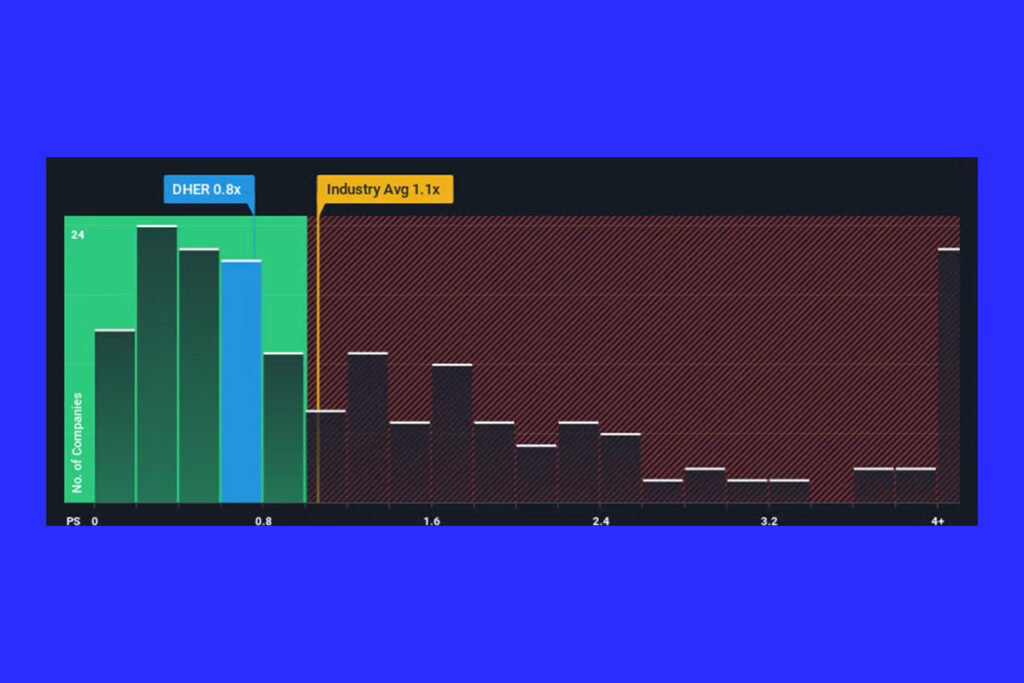

Delivery Hero’s price-to-sales (or “P/S”) ratio of 0.8x at the moment appears quite “middle-of-the-road” in comparison to the hospitality industry in Germany, where the median P/S ratio is approximately 0.6x, even with such a significant price increase. Despite the fact that this might not cause concern, investors risk missing out on a chance or disregarding impending disappointment if the P/S ratio is not justified.

Despite Recent Gains, Delivery Hero’s Stock Lags Behind in Year-Over-Year Performance

The recent revenue growth of the sector and Delivery Hero’s have little in common. The P/S ratio has been hampered by the widespread expectation that the poor revenue performance will continue. If this is the case, then current shareholders won’t be too worried about the share price at this point.

According to analysts who monitor the company, sales are expected to increase by 13% annually over the next three years. The company is positioned for a comparable revenue result, given the industry’s projected 12% annual growth. It makes sense that Delivery Hero’s P/S is comparable to that of the majority of other businesses in light of this. It seems that while the corporation is keeping a low profile, shareholders are content to just hang on.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a Reply