What You Need to Know About Berkshire Hathaway 13-F Filing

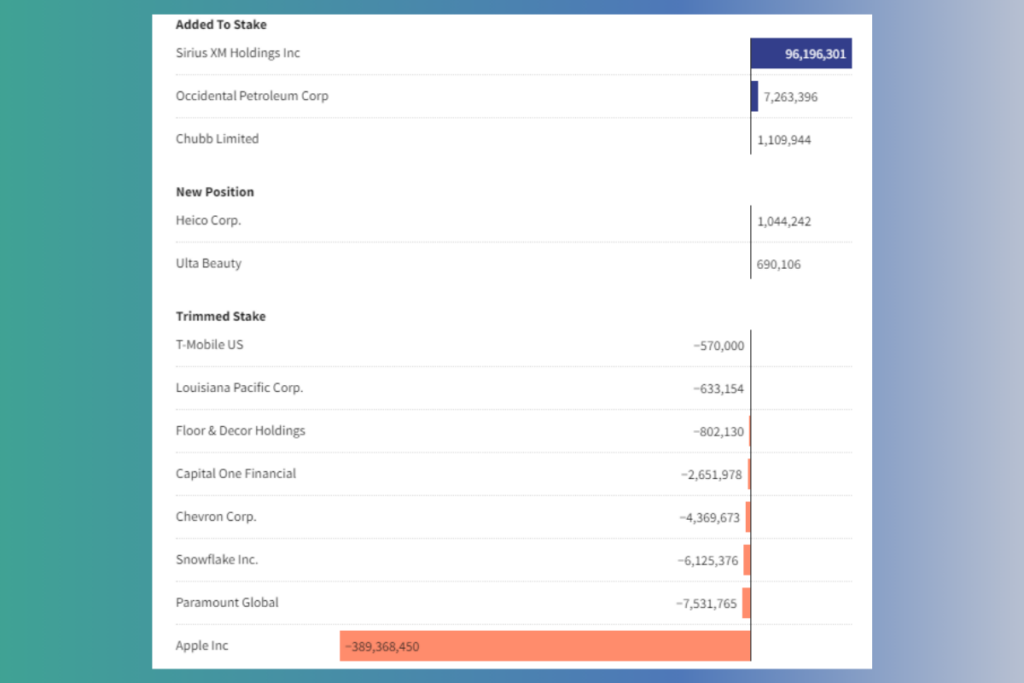

In the second quarter of this year, shares in the aerospace and electronics manufacturing company Heico Corp. (HEI) and the beauty goods company Ulta Beauty (ULTA) were purchased by Warren Buffett‘s Berkshire Hathaway, according to a regulatory filing on Wednesday. It was also confirmed in the 13-F filing that Berkshire substantially reduced its stake in Apple Inc. (AAPL). Roughly one-third of Berkshire’s portfolio still consists of Apple shares.

- It’s crucial to remember that 13-F filings only offer a quarter-end portfolio snapshot.

- All of the Bank of America (BAC) shares that the corporation sold in July are not included in this Berkshire report because it provides no information on any transactions that have occurred since June.

- It also doesn’t give any information regarding profits or losses from any sales.

Berkshire Hathaway Withdraws from Paramount and Snowflake

The document showed the company’s withdrawal from Paramount Global (PARA), one of Buffett’s few misplaced wagers. At the annual shareholder meeting of Berkshire held in May, he had acknowledged selling all of the company’s shares for a loss, and he had sold off a significant portion of that position in the first quarter.

Additionally, the business sold Snowflake (SNOW), a technological startup, all of its shares. 6.1 million shares of the company, valued at approximately $989 million, were held by Berkshire at the end of the first quarter.

- As of June 30, Ulta Beauty had around 690,000 shares worth about $266 million that Berkshire Hathaway had purchased. After the stake was made public on Wednesday, the cosmetics company’s shares shot up 14% in extended trade.

- Additionally, after-hours trading saw a nearly 4% increase in Heico Corp.’s stock, which Buffett purchased in the amount of one million shares.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a Reply