Arbor Realty Share Price Starts to Fall Due to Federal Investigation: What Investors Need to Know

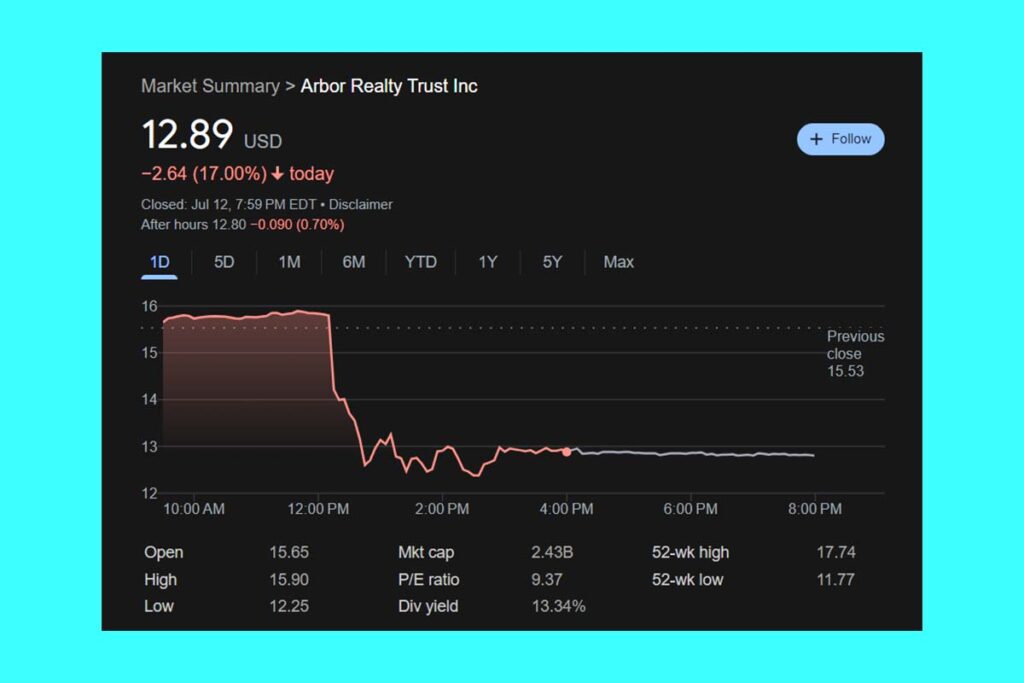

Among the firms facing significant selling pressure today is Arbor Realty (NYSE:ABR). As of this writing, shares of ABR had dropped more than 19%, wiping out all the gains the stock had made as of yesterday.

This action follows reports that the Department of Justice (DOJ) is looking into the lending practices and loan book of the company. It seems that short sellers have followed suit, as investors who are hoping to short commercial mortgage real estate investment trusts (REITs) seem to be targeting the trusts.

- The DOJ investigation has caused a more than 19% decline in Arbor Realty (ABR) stock.

- Specifically, regulators are examining the manner in which the corporation informed investors about its performance.

- This is only the most recent challenge facing the commercial real estate industry, which is already dealing with many serious challenges.

Arbor Realty Loan Book Investigation: DOJ Review Continues

According to reports, Arbor Realty’s disclosures on its loan book performance to investors are being scrutinized by the DOJ. The corporation hasn’t yet provided a comment because this is still an ongoing investigation. However, today’s action is reasonable in light of the allegations.

There is a big gray area in which many real estate companies operate since it is challenging to determine the true worth of real estate assets on a company’s loan book. It’s uncertain how likely this DOJ investigation will be to find evidence of misconduct. However, many investors are probably already looking for other choices in this space based on the probe alone.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a Reply