What Does Nokia Quarterly Sales Drop Mean for the Company?

Sales of Nokia Oyj in the second quarter fell short of analyst projections and were the lowest since 2015. This is because the market for 5G equipment is still being hindered by a lackluster investment in mobile network improvements. In comparison to the same quarter last year, net revenues decreased 18% to €4.47 billion ($4.9 billion) for the Espoo, Finland-based corporation, according to a statement released on Thursday.

- It contrasts with an average prediction of €4.76 billion made by Bloomberg’s panel of analysts.

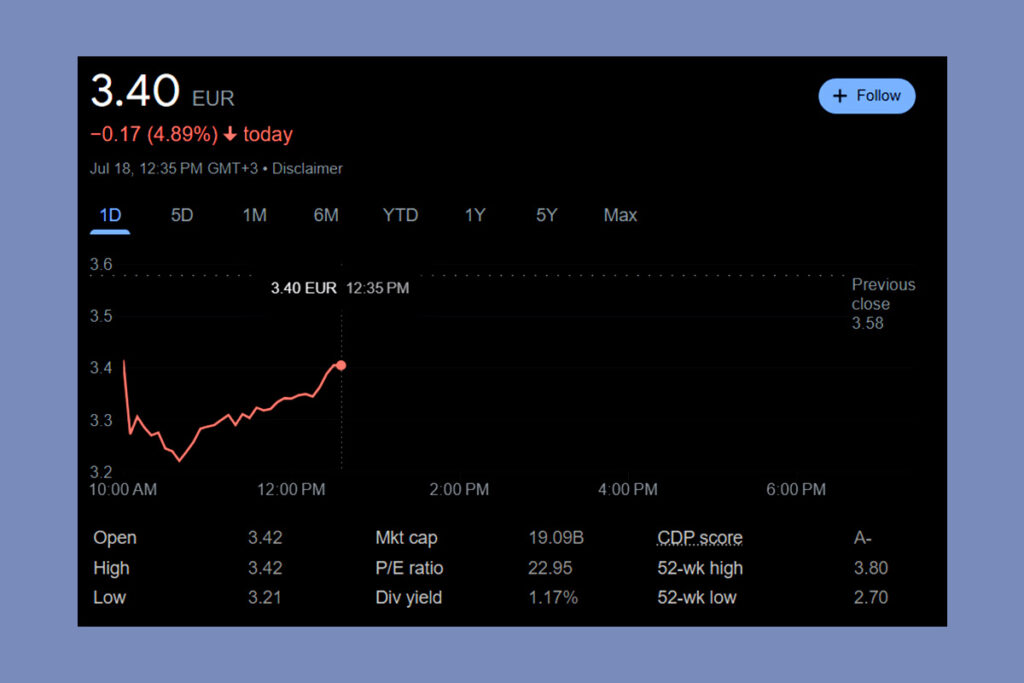

- In Helsinki, shares of Nokia dropped 9% to €3.26 at 10:28 a.m. Thus far this year, the stock has increased by 6.7%.

Nokia Reduces Workforce Due to 5G Investment Stagnation

For years, the market for telecom equipment has been dire for Nokia and its Nordic rival Ericsson AB, with few indications that mobile operators will make significant investments in 5G equipment anytime soon. In order to save expenses, both businesses eliminated thousands of positions and streamlined their operations in the past year.

Nokia’s network infrastructure segment has undergone significant adjustments as a result of the sluggish market for telecom equipment. One such move was the acquisition of Infinera last month, a $2.3 billion wager on the artificial intelligence-driven demand for data center services. Additionally, it intends to sell the French government its underwater cable company, Alcatel Submarine Networks.

The order backlog is growing and that’s obviously a factor that we are seeing. No question volumes are extremely weak at the moment when you look at the top line.

Nokia Chief Executive Officer Pekka Lundmark

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a Reply