TSX Composite Index Decrease as Recession Fears Intensify and Commodities Prices Fall

The recent U.S. jobs report stoked fears of a near-term recession, causing the TSX Composite benchmark to fall 2.4% last week after advancing for four straight weeks. Friday saw a second straight day of declines in Canadian stocks as concerns about a potential near-term recession were heightened by the most recent domestic jobs statistics and U.S. non-farm payrolls.

The S&P/TSX Composite Index fell by 207 points, or 0.9%, to 22,781, its lowest closing level in more than three weeks, as a result of these stories and lower commodities prices. All major market sectors finished the day lower, but the selloff was primarily driven by significant losses in IT, consumer cyclical, and mining companies.

- With losses of at least 5.2%, Celestica, CES Energy Solutions, Hudbay Minerals, and Methanex were the worst-performing TSX companies of the day.

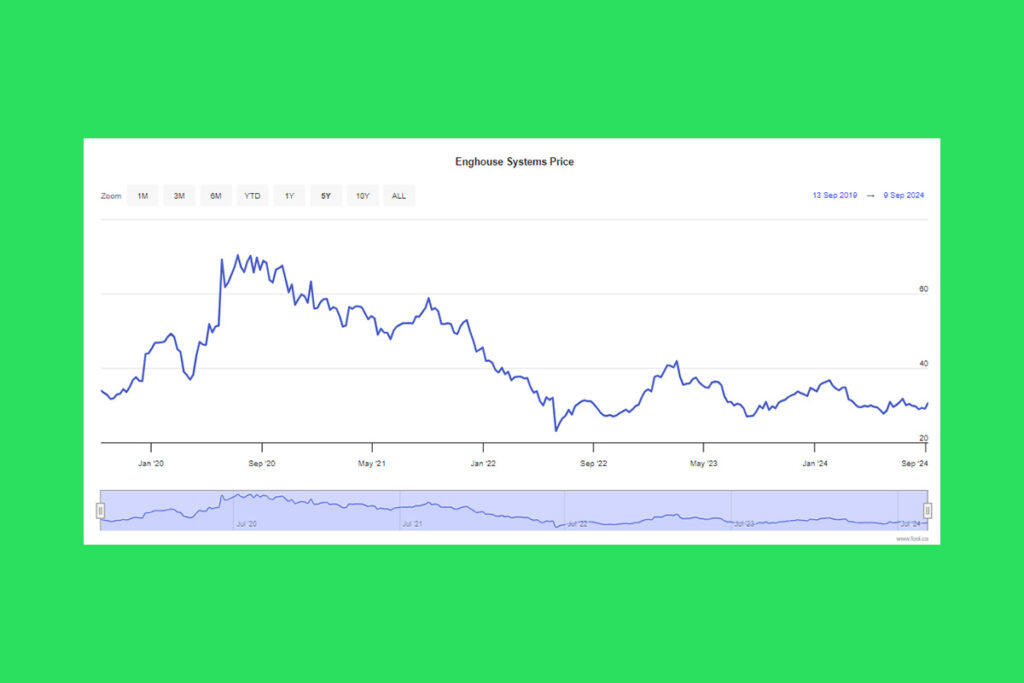

- The best-performing TSX stock during the previous session was Enghouse Systems, which had a 5.6% increase in share price to $30.61.

- On the Toronto Stock Exchange, North West Company and Pet Valu Holdings were also among the best performers of the day, rising by at least 2.6% apiece.

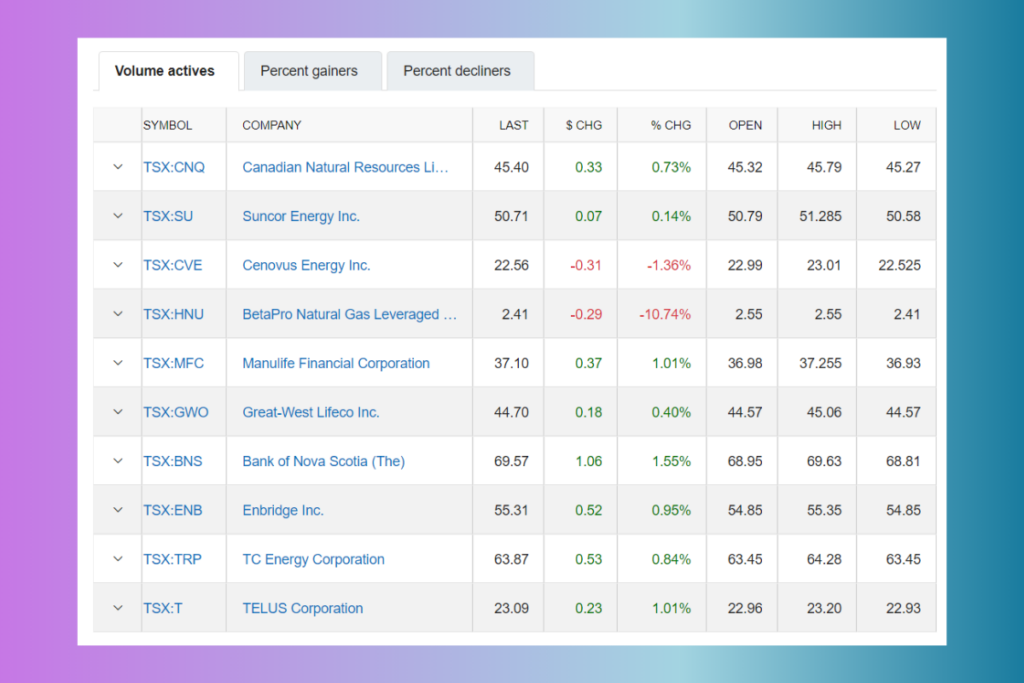

- The most active equities on the exchange were Suncor Energy, Canadian Natural Resources, Enbridge, Manulife Financial, and Baytex Energy based on their daily trade volume.

Mixed Commodity Prices Keep TSX Index Flat Amid Fed Policy Uncertainty

Early on Monday morning, commodity prices were mainly mixed, indicating that the resource-heavy main TSX index would open flat today. Even though there are no significant economic reports scheduled for yesterday morning, markets could stay erratic as traders continue to evaluate the most recent U.S. jobs data and form their predictions for the Federal Reserve‘s policy decisions.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a Reply