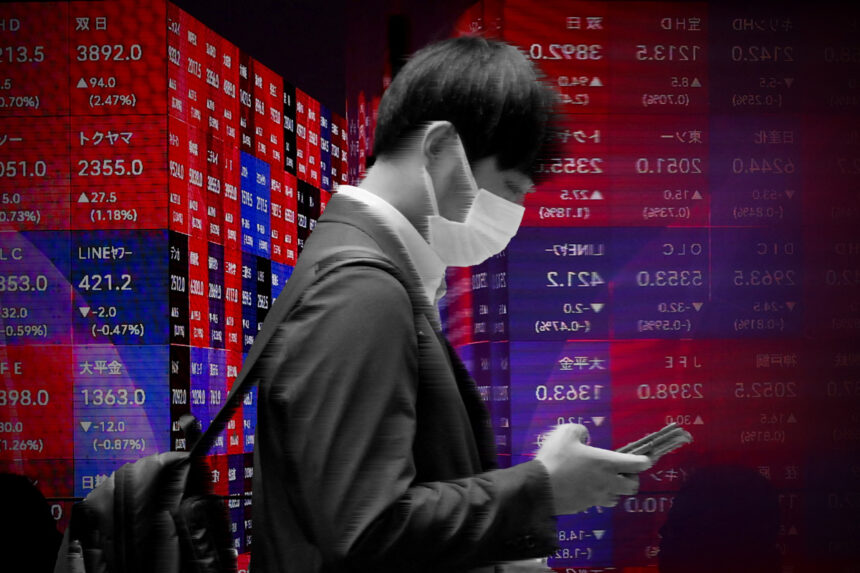

Nikkei Shares Fall Sharply: Yen Rises and Seven & I Bounces

The retailer Seven & I Holdings increased 23% after receiving a buyout bid, while the 225-issue Nikkei average continued to decline on Monday. This was due to the yen’s strengthening relative to the dollar. The Nikkei index ended a five-day winning run that had seen the index rise 8.7% last week by closing 1.77% lower at 37,388.62.

The Nikkei was expected to fall this week after its sharp rally, but the yen’s gain against the dollar during the session pushed that move faster. Today’s move suggests that the market will remain volatile for a while.

Fumio Matsumoto, chief strategist at Okasan Securities

Dollar Declines, Nikkei Under Pressure Ahead of Fed’s Dovish Stance and Powell’s Speech

A dovish tone developing in the U.S. Federal Reserve’s July policy meeting minutes and Chair Jerome Powell’s impending speech at Jackson Hole were the main causes of the dollar’s broad drop, which saw it slip significantly against the yen in particular. Tokyo Electron, which makes chips, fell 3.11%, dragging the Nikkei the most.

- Contrary to the trend, Seven & I jumped 23% to a daily limit high when the firm, which runs the 7-Eleven convenience store chain in the nation through its subsidiary Seven-Eleven Japan, announced that it had received a preliminary buyout bid from Alimentation Couche-Tard in Canada.

- It further stated that although Seven & I has established a special committee to examine the idea, neither the committee nor the board of directors have taken a decision.

- 191 equities of the 225 Nikkei components declined, 22 rose, and one was unchanged.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a Reply