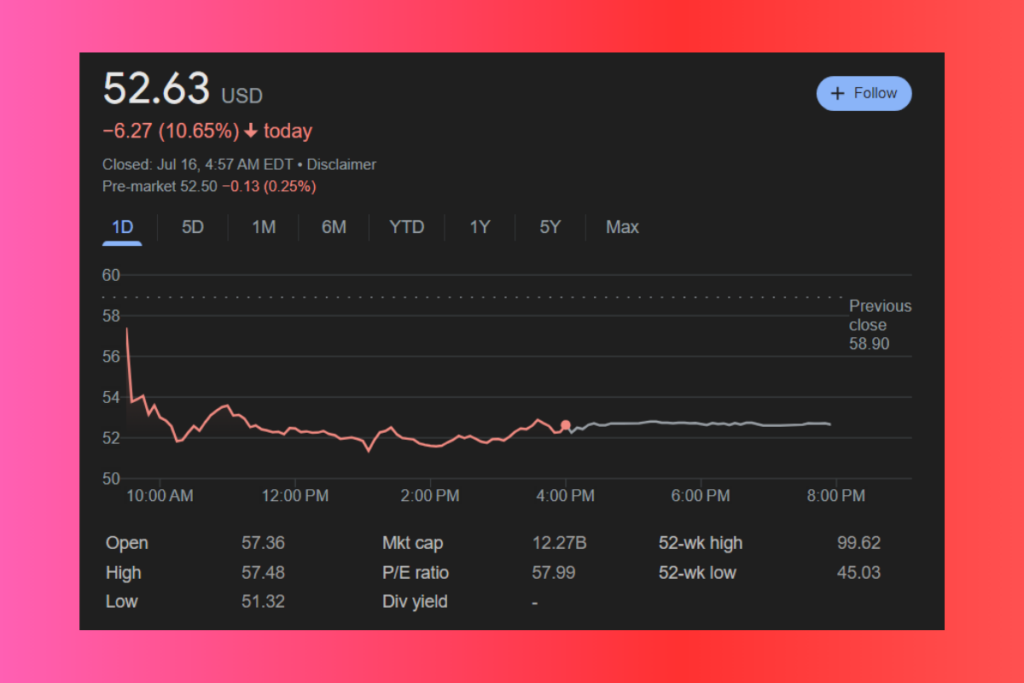

What Caused the 10% Crash in Celsius Holdings Shares?

The earnings season is almost here, and Wall Street analysts are hedging their bets on who will beat and who will let investors down. Apparently, this is negative news for Celsius Holdings (NASDAQ: CELH) investors. Robert Moskow, an analyst with TD Cowen, lowered his price objective for the energy drink company by 20% to $68 per share this morning and cautioned investors to have lower expectations.

Celsius Holdings Shares: Why Are Analysts Pessimistic?

Investors who have been overly optimistic about Celsius’s prospects in an economy where consumer spending is becoming more circumspect are the issue here. The analyst points out that Pepsico just released its unimpressive second-quarter profits, in which price increases were the main source of sales growth and no improvement in sales volumes occurred.

This is not good news for Celsius and other drink producers. The Fly has a letter from Moskow today that highlights the ongoing slowdown in sales and cautions that “consensus estimates for FY24 and FY25 sales are too high given the continued deceleration in sales growth.” If he is correct in that regard, forecasts for profit and the potential price increase of Celsius stock are also likely overly optimistic.

- Most analysts predict that Celsius will return $1.08 per share this year, meaning the stock has a current-year P/E of 48.

- Considering that sales are expected to climb by 22% this year, that is rather expensive.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a Reply