Snow stock- Snowflake price target reaffirmed by Goldman, added to top list

Snow stock– The Goldman Sachs Group has reaffirmed their buy rating on Snowflake (NYSE: SNOW), setting a price target of $220.00. This target suggests a significant upside of more than 50% from the stock’s recent closing price of $142.77. The endorsement from Goldman Sachs underscores their confidence in Snowflake’s prospects, particularly as a leading provider in the cloud-based data platform sector.

This Renewal Resonated with the Financial Community

This reaffirmation has resonated across the financial community, with analysts echoing their positive sentiments as they evaluate Snowflake’s performance and growth potential. As a pivotal player in leveraging cloud technology for data management and analytics, Snowflake continues to attract attention for its innovative solutions and market position.

Goldman Sachs’ buy rating and optimistic price target reflect their belief in Snowflake’s ability to capitalize on ongoing digital transformation trends and expand its market presence. This endorsement is likely to influence investor sentiment and further solidify Snowflake’s standing in the competitive landscape of cloud computing and data analytics.

Goldman Sachs’ Ambitious Price Target and Snowflake’s Standout

Accompanying Goldman Sachs’ ambitious price target is Snowflake’s inclusion in the firm’s Americas Conviction List, highlighting the increasing use of Snowflake’s data platform as a catalyst for AI advancements. Despite recent price drops, optimistic price targets contrast sharply with current market movements, suggesting potential for significant upward momentum.

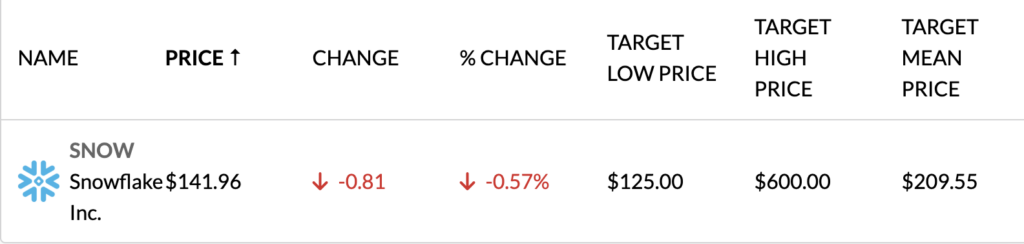

Oppenheimer maintains an outperform rating, setting a target of $220.00, while Needham & Company LLC reaffirms a buy rating with a slightly lower target of $210.00. Reflecting analyst sentiment, the consensus among over 30 analysts tracking the stock is above $200, indicating widespread bullishness despite the stock’s year-to-date decline of nearly 25%.

These developments underscore confidence in Snowflake’s strategic position in the cloud-based data sector, driven by its innovative solutions and anticipated role in advancing AI applications. As Snowflake continues to expand its market influence, investor optimism remains buoyant, buoyed by favorable analyst assessments and strategic endorsements from leading financial institutions.

Snowflake’s Financial Position and Market Analysis

Snowflake’s financial standing and market dynamics offer valuable insights into its current status. The stock has demonstrated volatility, ranging from a 12-month low of $122.60 to a high of $237.72. Investors commonly monitor the 50-day and 200-day moving averages, currently at $145.65 and $172.66, respectively, to gauge trend patterns.

With a substantial market capitalization of $47.79 billion, Snowflake’s price-to-earnings ratio stands at a negative -50.98, reflecting unique market conditions. The stock’s volatility, captured by a beta of 0.85, indicates its sensitivity to market fluctuations.

Recent earnings reports reveal Snowflake’s per-share earnings at -$0.88, trailing behind analyst consensus estimates. However, the company reported robust quarterly revenue of $828.71 million, underscoring its operational scale and growth trajectory.

Snowflake Inc. specializes in the Data Cloud, an innovative cloud-based platform serving diverse industries. This platform enables users to consolidate data, extract critical business insights, develop data-driven applications, and share data products, leveraging artificial intelligence to tackle complex challenges.

Analysts foresee significant upside potential for SNOW, but caution is advised. Financial commentators often hold active positions in stocks they cover, and forecasts can swiftly change. It’s prudent to conduct thorough due diligence on fundamentals and business operations before making investment decisions, whether concerning Snowflake or any other company.

Snow stock: Goldman Sachs Reaffirms Buy Rating

- Reaffirmation by Goldman Sachs: The Goldman Sachs Group has reiterated their buy rating on Snowflake (NYSE: SNOW), maintaining a price target of $220.00. This represents a substantial upside of more than 50% from Snowflake’s recent closing price of $142.77.

- Confidence in Snowflake’s Prospects: Goldman Sachs’ reaffirmation underscores their confidence in Snowflake’s future prospects. As a prominent player in the cloud-based data platform sector, Snowflake is recognized for its innovative solutions and market leadership.

- Endorsement Echoes Across the Financial Community: The reaffirmation from Goldman Sachs has resonated positively within the financial community. Analysts have echoed these sentiments, highlighting Snowflake’s strong performance and growth potential.

- Position in Cloud Technology: Snowflake leverages cloud technology for advanced data management and analytics. This strategic focus positions the company to capitalize on ongoing digital transformation trends, driving its market presence and competitive edge.

For the latest in crypto updates, keep tabs on Crypto Data Space.

Leave a Reply