What Lessons Can be Learned from the 22-29 June Biggest Crypto Market News?

Welcome to this week’s edition of our Crypto Trends Newsletter! Dive into the latest market developments with insights on Solana’s ETF approval, sparked by VanEck’s first US ETF filing, leading to a notable price surge. We also provide a detailed analysis of whale activity and its impact on Bitcoin prices. Additionally, Immunefi’s report reveals a staggering $509 million loss in crypto hacks for Q2 2024, underscoring the critical need for enhanced security measures. Stay informed and secure in the ever-evolving crypto landscape!

✍️ This week’s significant crypto news:

- Possible Solana ETF Approval: Insights From VanEck Researcher Matthew Siegel

- VanEck’s Solana ETF Filing: SOL Classified As Commodity Investment

Solana ETF Approval Insights: Key Developments and Market Impact

Solana ETF Approval Likely

VanEck’s head of research, Matthew Sigel, predicts the approval of a Solana ETF following the successful approval of Bitcoin and Ethereum spot ETFs. VanEck has filed for the first Solana ETF in the US, aiming to provide institutional investors access to Solana.

Ethereum ETF Filings

VanEck, along with BlackRock, Fidelity, and five other firms, is awaiting regulatory approval for Ethereum ETF filings, emphasizing the growing institutional interest in crypto assets.

Solana’s Competitive Edge

Solana‘s strong market performance, high trading volumes, and positive decentralization ratings position it favorably for ETF approval, making it an attractive option for investors.

Solana Price Surges Following VanEck’s First US ETF Filing

Significant Solana (SOL) Price Increase

In the last 24 hours, Solana (SOL) surged by 9%, reaching just below $150, after VanEck’s announcement of filing for the first Solana ETF in the US.

SOL Market Reactions and Solana Analysis

VanEck’s S-1 registration statement for the “VanEck Solana Trust” sparked optimism among investors, contributing to the price hike. Analysts had anticipated a Solana ETF following SEC approvals for Ethereum funds.

Crypto Technical Indicators

SOL broke the $140 resistance level, indicating bullish sentiment. The price moved above the EMA10 mark, suggesting potential for further gains. Key levels to watch are $150 resistance and $135 support.

🔐Whale Activity and Bitcoin Price Impact: Detailed Analysis

Major Crypto Whale Movement On June 28, 2024, a dormant whale wallet, inactive since 2018, transferred 1,000 BTC (valued at over $61 million) to Coinbase Pro. The wallet originally acquired the Bitcoin for $6.68 million, showcasing a significant profit.

Increased Crypto Whale Transactions Q2 2024 has seen a rise in inactive Bitcoin wallets transferring large amounts to exchanges. This activity coincided with a 9% drop in Bitcoin prices, driven by sales from long-term holders and miner liquidations.

Crypto Market Implications Whale movements can indicate market shifts, with large transfers potentially causing significant price fluctuations and altering trading behaviors.

Stay Updated: Keep informed about the latest crypto news and catch the market flow.

💵Immunefi Reports $509M Lost in Crypto Hacks in Q2 2024

In Q2 2024, Immunefi recorded $509 million in crypto losses, up 91% from 2023. Centralized exchanges like DMM Bitcoin were major targets, losing $305 million. Ethereum was the most attacked blockchain. May 2024 alone saw $107 million in losses, but June’s losses dropped to $78 million, 27% less than June 2023.

Massive Year-on-Year Increase Crypto: The 91% rise in losses from the previous year highlights the urgent need for improved security protocols across the crypto industry.

Centralized Exchange Vulnerabilities: With significant breaches like the $305 million loss at DMM Bitcoin, centralized exchanges must prioritize security enhancements.

Focus on Ethereum Updates: As the most targeted blockchain, Ethereum’s security is critical for the stability of the DeFi ecosystem.

May Crypto 2024: This month was particularly severe, with reported losses amounting to $107 million. The concentration of attacks in May signals potential vulnerabilities that may have been exploited during this period.

June Crypto 2024: Despite the high losses in May, June saw a relative decrease in reported losses, totaling $78 million. This represents a 27% drop compared to June 2023, indicating some mitigation efforts may be taking effect.

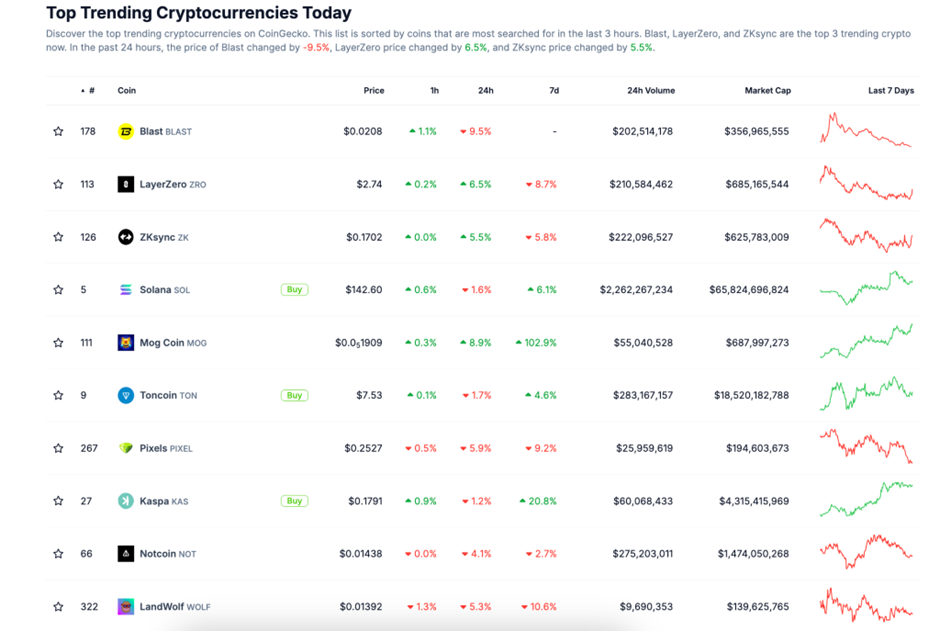

Top 10 Trending Crypto Today

![🔥]() THIS WEEK TREND CRYPTO NEWS

THIS WEEK TREND CRYPTO NEWS

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a Reply